Blog Post

Insight: Utah’s Top-20 Homebuilder Sentiment Survey

By: Dejan Eskic

In late 2018, the Kem C. Gardner Policy Institute was invited to participate in a survey of the top-20 homebuilders in Utah. The goal of the survey was to understand homebuilders market outlook, sentiment, and overall challenges and solutions.

As housing prices continue to rise and affordability keeps its rank as a major policy issue in Utah, homebuilders find themselves navigating a tricky market. While price increases can seem like a great sign for homebuilders, construction costs are near an all-time high. Additionally, our state’s growth comes with growing pains, which have translated to a challenging political environment when it comes to building housing, especially high-density housing.

Overall, homebuilders’ outlook for Utah’s housing market is good, but with a sense of caution.

The cautions stem from major issues identified in the survey – affordability, interest rates, labor costs, NIMBY-ism, and lot improvement costs. The most challenging issue for builders is affordability. Buyers are becoming hesitant and feel the market is overheated. As one builder put it, “every month is a battle and nothing is coming easy” regarding sales. Impacting affordability are rising interest rates which rose almost 100 basis points last year, but have dropped recently. Some builders noted the increasing rates have led to cancelations. The labor market is extremely tight. The competition for labor is adding to its cost. The demand for framers, exterior construction specialists, and plumbers are the top demanded trades for the homebuilders. NIMBY-ism is at an all-time high, increasing the uncertainty of approvals in some areas. Additionally, land and horizontal improvement costs are at their highest.

Fortunately, there is a positive side of this equation in the strong demand for housing. The number of closed units for the top-20 builders increased from 6,200 in 2017 to 7,430 in 2018, growing 20 percent. This led to total combined revenues to grow 25 percent from $2.30 billion in 2017 to $2.87 billion in 2018. Purchase price also grew 4.2 percent, increasing from approximately $371,000 per unit in 2017 to $386,000 per unit in 2018.

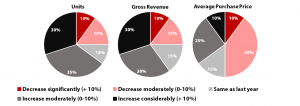

The outlook for the number of units in 2019 is positive overall, 65 percent are expecting a moderate to considerable increase, while 25 percent expect some decrease, and 10 percent see no change (Figure 1). Sixty percent of builders expect revenues to increase, 25 percent forecast a decrease, and 15 percent expect revenues to stay the same.

The outlook for purchase prices is a cause for concern. Half of the top-20 homebuilders expect to see a decrease in the average purchase price in 2019, while 35 percent expect some increase, and 15 percent think it will stay unchanged.

Figure 1: Outlook for Top-20 Homebuilders, 2019

Source: Top-20 Homebuilder Survey, 2018.

Homebuilders noted that our market has likely “hit an emotional threshold” regarding price. To mitigate the price increase, builders are starting to transform their product. This includes decreasing the square feet of a home and minimizing customization options. Homes offering little to no customization are likely to increase five percent this year. Additionally, builders are expected to increase the number of condos/townhomes by almost 10 percent in 2019. In 2018 they increased 18 percent from 2017.

This product shift explains the homebuilders’ expectation for a decrease in average purchase price in 2019. Additionally, costs aren’t likely to slow down anytime soon. The price decrease, combined with a decrease in average purchase price will hurt the bottom line. In 2018, 55 percent of homebuilders saw an increase in margins, only 25 percent are expecting positive impacts in 2019.

Dejan Eskic is a senior research analyst at the Kem C. Gardner Policy Institute.