Blog Post

Insight: The Great Resignation: How Has It Impacted Utah’s Health Care Industry to Date?

By: Laura Summers and John Downen

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Dec 13, 2021 – In February 2021, we produced a blog on The Impact of COVID-19 on Utah’s Health Care and Social Assistance Industry. Since then, we’ve learned more about the “Great Resignation” of 2021, or the trend of employees voluntarily leaving their jobs. Despite being known as a recession-resilient sector, there is concern that health care is one of the industries being hit hardest by this exodus.

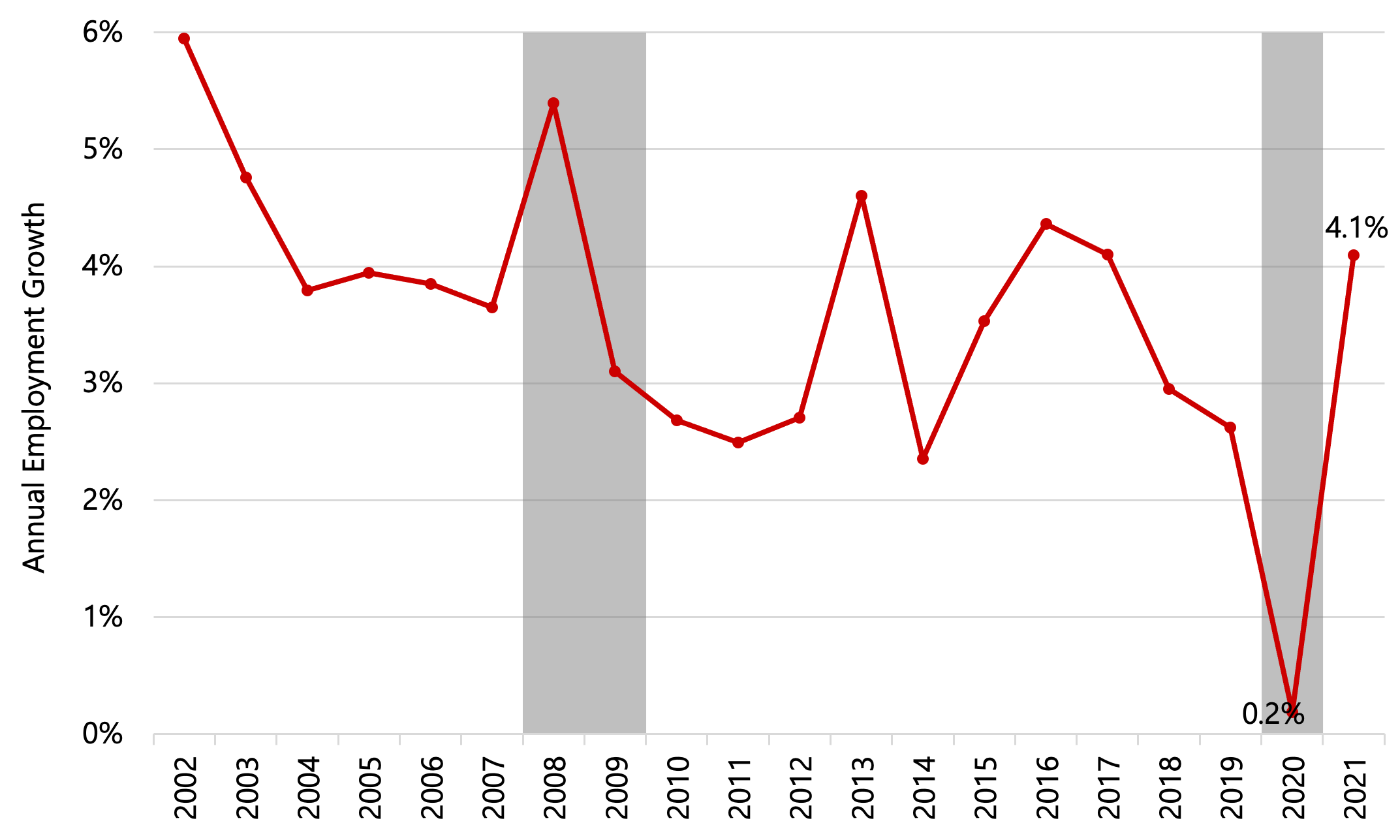

Interestingly, data from the Utah Department of Workforce Services show that Utah’s health care and social assistance industry rebounded in the first half of 2021, with a positive growth rate of 4.1%. Figure 1 shows the annual percent change in employment from 2002 to 2021 (using data for the first half of each year since numbers are currently available through only the first six months of 2021).

It is important to note, however, that the Great Resignation is based on “quits” data, or the number of people who willingly left their jobs. Unfortunately, state-level data are not available for the number of workers in the health care and social assistance industry who have quit. The data below represent net changes in employment, or hires minus quits and other “separations.” So as long as there were more hires than quits in a given timeframe, the data would show positive employment growth.\

Figure 1: Change in Average Employment in Utah’s Health Care and Social Assistance Industry for the First Half of Each Year, 2002‒2021

Note: The health care and social assistance sector comprises establishments providing health care and social assistance for individuals. Establishments in this sector deliver services by trained professionals. For more information, see https://www.naics.com/naics-code-description/?code=62. NBER-dated recessions in gray.

Source: Kem C. Gardner Policy Institute analysis of Utah Department of Workforce Services data

and Federal Reserve Bank of St. Louis

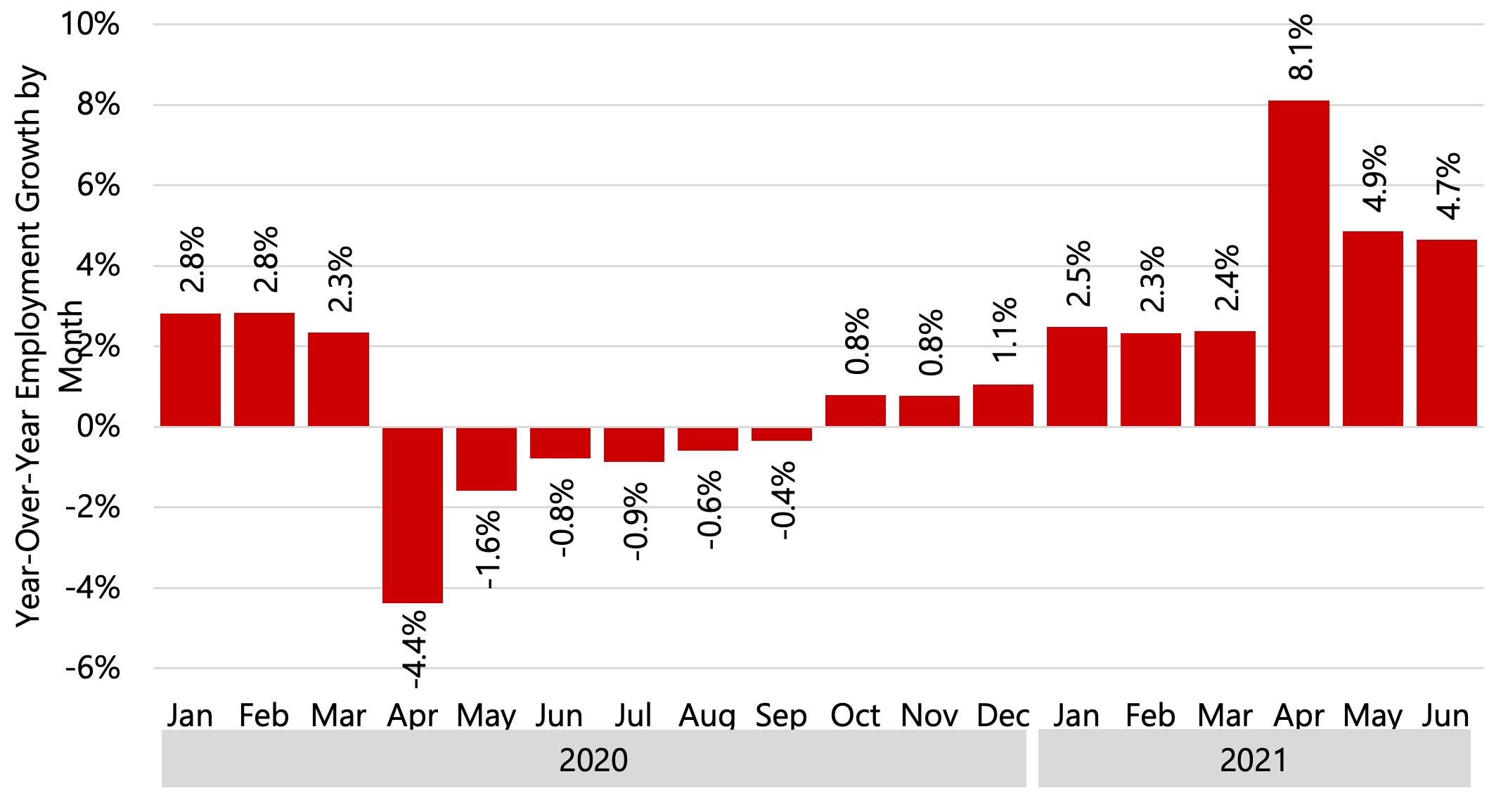

Breaking down the data on a month-to-month basis confirms that net declines in employment were limited to the early part of the pandemic. Figure 2 shows employment declines in Utah’s health care and social assistance industry began in April 2020 and continued through September, before turning around to continual positive growth starting in October 2020.

Figure 2: Year-Over Change in Monthly Employment in Utah’s Health Care and Social Assistance Industry, January 2020–June 2021

Source: Kem C. Gardner Policy Institute analysis of Utah Department of Workforce Services data

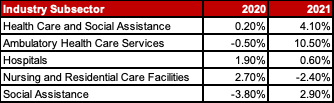

That said, not all subsectors within the health care and social assistance industry have experienced positive rebounds in employment. Table 1 includes the percent change in employment for the first half of each year in 2020 and 2021 for four different subsectors within the health care and social assistance industry: (1) ambulatory health care services, (2) hospitals, (3) nursing and residential care facilities, and (4) social assistance.[i]

The ambulatory health care services sector experienced a slight decline in overall employment in the first half of 2020, which was followed by a significant increase in the first half of 2021 (10.5% growth). Comparatively, the hospital subsector experienced positive growth in both 2020 and 2021, but growth was slowing over these two years. The nursing and residential care facilities subsector experienced the largest drop in employment to date, with a 2.4% decline in employment between the first half of 2020 and 2021. The social assistance subsector also experienced a decline in 2020, but this was offset by 2.9% positive growth in 2021.

Table 1: Year-Over Change in Average Employment in Utah’s Health Care and Social Assistance Industry Subsectors for the First Half of Each Year, 2020 and 2021

Source: Kem C. Gardner Policy Institute analysis of Utah Department of Workforce Services data

Based on this data alone, it appears the “Great Resignation” of 2021 has been limited to specific subsectors within Utah’s health care and social assistance industry. That said, there is definitely more to uncover on this issue.

First, as noted above, state-level data are not available for the number of workers in the health care and social assistance industry who are quitting or leaving their jobs. As such, the data here represent the net changes in health care employment. Interestingly, national data show a marked increase in both the level and the rate of health care and social assistance quits in March through September of this year, but also steadily growing total health care and social assistance employment over the same period. This could indicate that the impacts of the Great Resignation on health care may not be visible at the industry level as workers are likely not leaving the industry itself, but switching occupations or even subsectors within the industry.

Second, current data from the Utah Department of Workforce Services are available only through June 2021, whereas some sources indicate that the Great Resignation didn’t begin until spring or summer 2021—meaning the real impact may be yet to be seen. To provide some insight into what may be coming, we also examined data from the Bureau of Labor Statistics’ (BLS) Current Employment Statistics, which provide state-level employment estimates through October 2021. While there are some differences between the two datasets, the BLS data generally support the overall trends seen in the data from the Utah Department of Workforce Services—and in some cases the estimates point to more positive growth through fall 2021.

Third, the impact on different occupations within each subsector may be masked by aggregated data. While the subsector as a whole may have experienced positive growth, certain health care occupations within that subsector may be experiencing more dramatic decreases.

Finally, the data don’t reflect demand for services, which could be outpacing positive growth in employment. Many areas in Utah are already classified as health professional shortage areas, and slowing growth or declines in employment could worsen these shortages.

It is often said that Utah’s health care industry is increasingly impacted by workforce shortages, which have been exacerbated by COVID-19. The two-decade trend of slowing growth seen in Figure 1 may be related to this, but to truly understand the impact of COVID-19 and the Great Resignation, further data and data monitoring will be needed over the next six to 12 months and beyond.

Laura Summers is the senior health care analyst at the Kem C. Gardner Policy Institute.

John Downen is the deputy director of economic and public policy research at the Gardner Institute.

[i] Industries in the ambulatory health care services subsector provide health care services directly or indirectly to ambulatory patients and do not usually provide inpatient services. Health practitioners in this subsector provide outpatient services, with the facilities and equipment not usually being the most significant part of the production process. Industries in the hospitals subsector provide medical, diagnostic, and treatment services that include physician, nursing, and other health services to inpatients and the specialized accommodation services required by inpatients. Hospitals may also provide outpatient services as a secondary activity. Establishments in the hospitals subsector provide inpatient health services, many of which can only be provided using the specialized facilities and equipment that form a significant and integral part of the production process. Industries in the nursing and residential care facilities subsector provide residential care combined with either nursing, supervisory, or other types of care as required by the residents. In this subsector, the facilities are a significant part of the production process and the care provided is a mix of health and social services with the health services being largely some level of nursing services. Industries in the social assistance subsector provide a wide variety of social assistance services directly to their clients. These services do not include residential or accommodation services, except on a short-stay basis.