Blog Post

Insight: The Impact of COVID-19 on Utah’s Health Care and Social Assistance Industry

By: Laura Summers

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Feb 17, 2021 – In addition to ensuring rapid and effective distribution of COVID-19 vaccines, one of our state’s top priorities for 2021 is economic advancement. For example, the One Utah Roadmap outlines plans for promoting talent development, infrastructure investment, sustainable growth, innovation and entrepreneurship, fiscal responsibility, and strategic industry advancement by building on Utah’s industrial strengths.

One established, and stable, industry in Utah is the health care and social assistance sector. This industry has long been known as a recession-resilient sector, experiencing positive year-over-year growth since at least 1991. Like most industries, however, the health care and social assistance industry was negatively impacted by COVID-19.

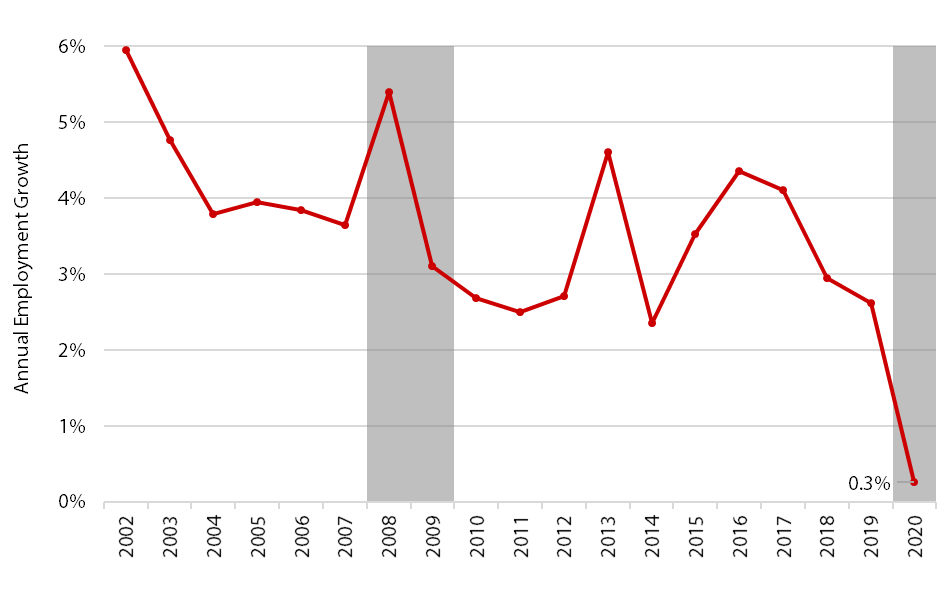

Figure 1 shows the annual percent change in employment from 2002‒2020 (using data for the first half of each year since numbers are currently available through only the first six months of 2020). It shows that growth significantly slowed in 2020 compared with 2019, but remained positive (0.3%). Survey data from the Bureau of Labor Statistics’ (BLS) Current Employment Statistics supports this trend as it provides state-level employment estimates through December 2020. These data show that Utah’s health care and social assistance industry is estimated to have 0.7% positive growth between 2019 and 2020.

Figure 1: Change in Average Annual Employment in Utah’s Health Care and Social Assistance Industry for the First Half of Each Year, 2002‒2020

Note: The Health Care and Social Assistance sector comprises establishments providing health care and social assistance for individuals. Establishments in this sector deliver services by trained professionals. For more information, see https://www.naics.com/naics-code-description/?code=62. NBER-dated recessions in gray.

Source: Utah Department of Workforce Services and Federal Reserve Bank of St. Louis

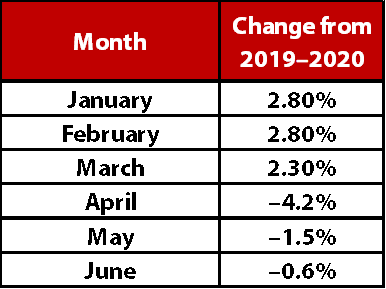

Breaking the data down on a month-to-month basis shows that the early part of the pandemic largely drove this decline. Employment in the health care and social assistance industry increased by over 2% in January through March 2020 (compared with the same months in 2019) but fell by 4.2% in April 2020. The decline moderated in May and June, falling by only 1.5% and 0.6%, year-over-year, respectively (Table 1). This decline is expected to continue to moderate from July to December as well, given that data from BLS’s Current Employment Statistics estimate overall positive (although moderate) growth for 2020.

Table 1: Annual Change in Monthly Employment in Utah’s Health Care and Social Assistance Industry for January‒June, 2019‒2020

Source: Utah Department of Workforce Services

Despite the recent declines in the health care and social assistance industry, the industry as a whole has proven to be stable, promotes economic growth, and supports the health and well-being of individuals. That said, there may be more to uncover on this issue. Future analyses planned by the Gardner Institute will observe these trends over a longer period of time, examine data for specific sectors within the health care and social assistance industry, and compare how these trends vary regionally within Utah.

Laura Summers is the senior health care analyst at the Kem C. Gardner Policy Institute.