Blog Post

Insight: The Geography of Manufacturing in Utah

By: Max Backlund

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Sep 16, 2021 – Historically, the manufacturing industry has been an important employment sector for Utah. Recently, several very large manufacturers have announced their expansion plans in Utah, including a $380 million project from Northrup Grumman that will hire more than 3,000 people, and two projects from Malouf in Cache County that will include $575 million in capital investments and hire more than 5,400 people.[i] These projects show the great potential for expansion in Box Elder, Cache, Davis and Weber counties, which are poised to lead the way for the next wave of manufacturing growth in Utah.

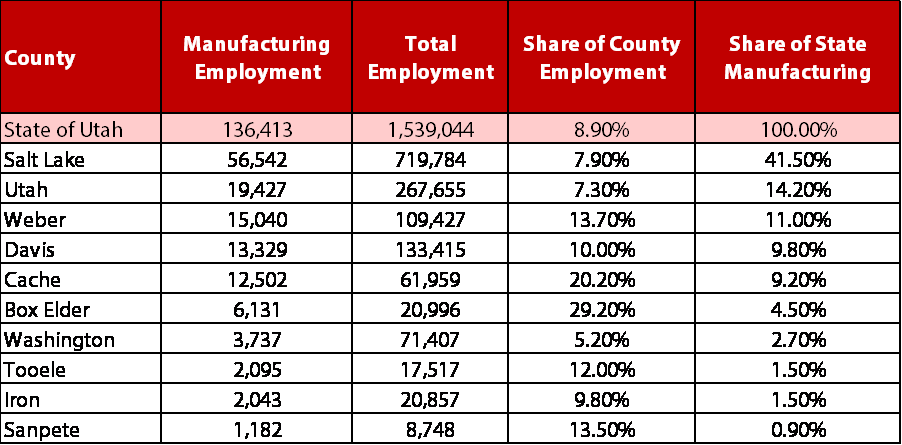

Compared to other major employment sectors in Utah, manufacturing is just as urbanized, but is more evenly distributed across the urbanized counties (see Table 1). Traditionally, the northern counties have been the growth areas for manufacturing employment.

Table 1: Top 10 Utah Counties for Manufacturing Employment, 2020

Source: Kem C. Gardner Policy Institute analysis of Utah Department of Workforce Services data

The top 10 counties account for 97% of all manufacturing employment in the state. The top five counties account for 86% of all manufacturing employment. In 2020 Salt Lake County accounted for 47% of total employment, but only 41% of all manufacturing employment. This is a relatively recent change, with Salt Lake County accounting for 45% of manufacturing employment in 2010.

Northern Utah counties feature prominently on this list. Apart from the Wasatch Front counties, which provide 77% of the state’s manufacturing employment, Cache, Box Elder, and Tooele rank fifth, sixth, and eighth respectively. These northern counties also include higher shares for manufacturing as part of their total employment.

Even though Washington County ranks fifth in total employment and population, it has similar manufacturing employment to Tooele County, which represents 25% of the employment and 39% of the population of Washington. In terms of total employment, Cache County is the most comparable market for Washington and it has four times as many manufacturing jobs as Washington.

Sanpete County represents a growing trend for rural communities, where manufacturing is increasingly important as an employment sector, but employment density remains comparatively low. As the 10th largest employment center for manufacturing, Sanpete accounts for 1.2% of all employment in the state and just 0.9% of manufacturing employment. It doubled its manufacturing employment between 2010 and 2020, from 602 to 1,182.

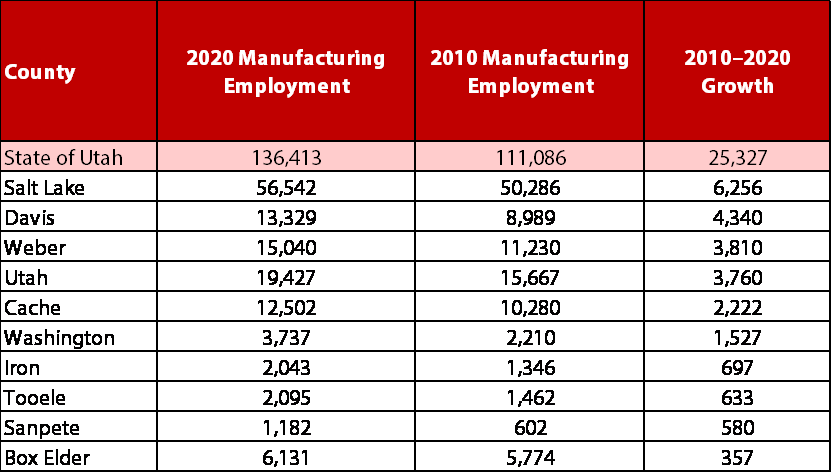

The northern counties of Davis, Weber, Cache and Box Elder accounted for 42.4% of the employment growth in manufacturing from 2010 to 2020 (see Table 2). Combined with Salt Lake, Utah and Tooele counties, this group of counties houses 84.4% of employment growth, while the other central and southern counties in the top 10 add 11.1%, leaving just 4.5% of the total growth for the remaining 19 rural counties in Utah.

Table 2: Top 10 Utah Counties for Manufacturing Employment Growth, 2010–2020

Source: Kem C. Gardner Policy Institute analysis of Utah Department of Workforce Services data

As opportunities for manufacturing growth increase, look for northern Utah to lead the way for years to come.

Max Backlund is a senior research associate at the Kem C. Gardner Policy Institute.

[i] See announcements from the Economic Development Corporation of Utah, https://www.edcutah.org/recent-news/malouf-companies-tm-to-expand-its-utah-headquarters and https://www.edcutah.org/recent-news/project-unity-northrop-grumman-to-expand-in-northern-utah