News Release

Salt Lake County rental rates increase by double digits in 2021; vacancy at 2%

March 9, 2022 (Salt Lake City) – Salt Lake County’s housing shortage and high home prices have led to the “tightest” apartment market in the county’s history, according to research released today by the Kem C. Gardner Policy Institute. In 2021, the vacancy rate dropped below 2%, and rental rates increased by double-digits.

“2021 was truly an unprecedented year for Salt Lake County’s apartment market,” said James Wood, Ivory-Boyer Senior Fellow at the Gardner Institute and lead author of the study. “Builders and developers have responded to the imbalance of rental units and renters with a record number of developments under construction and proposed, with growth projected to stay strong in the coming years.”

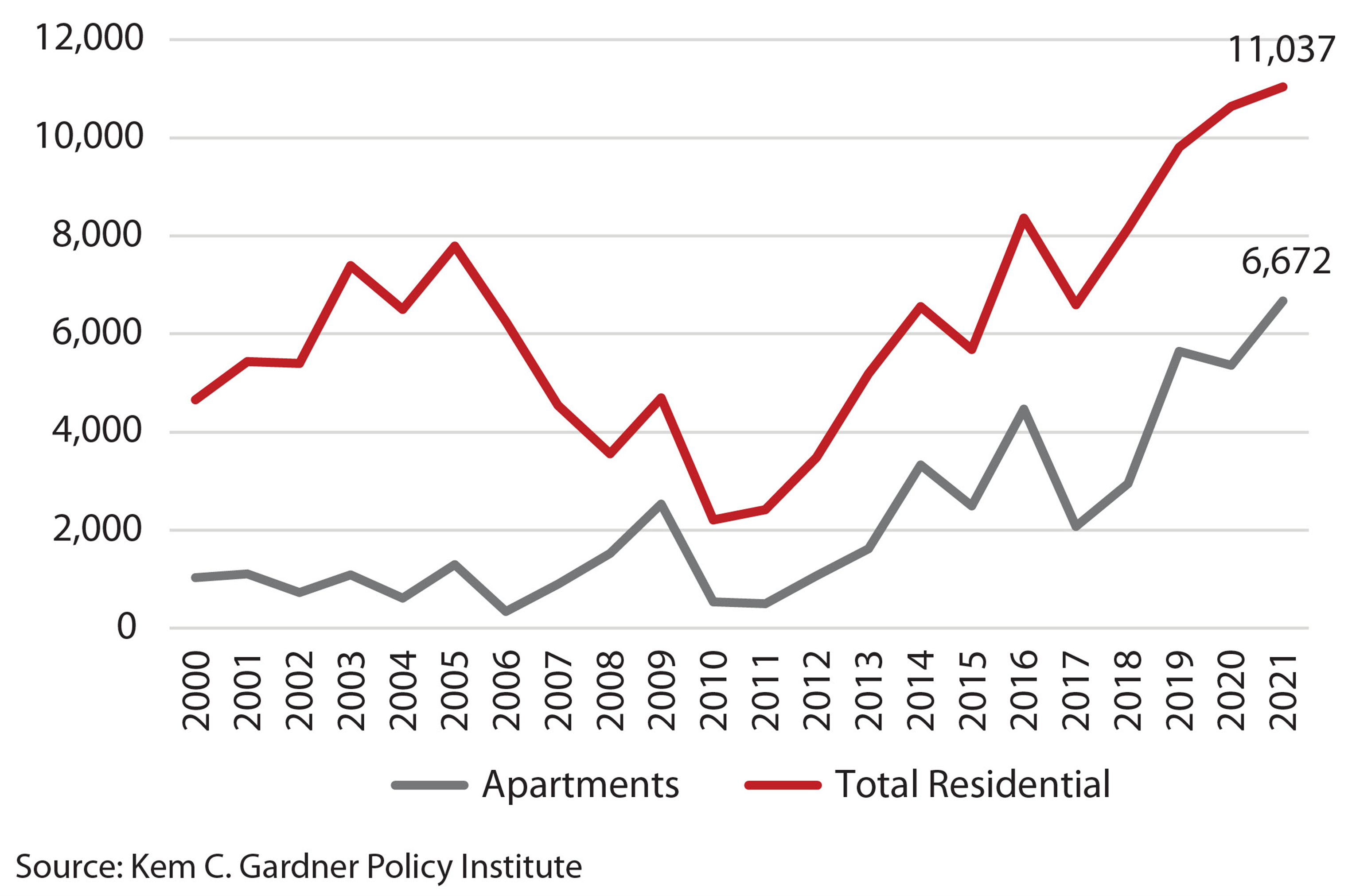

Permits Issued for Apartment Units in Salt Lake County, 2000-2021

Key highlights from the study include the following:

Unprecedented apartment boom – From 2000 to 2010, the number of permits issued for apartment units in Salt Lake County totaled 11,600 units, an average of about 1,100 units annually. This relatively modest level of apartment construction preceded the shift in demand to rental housing and the boom in apartment construction following the Great Recession. From 2011 to 2021, 34,500 apartment units received building permits, triple the level of activity during the 2000–2010 period.

Construction concentrated in Salt Lake City and Downtown – Since 2014, 43% of the apartment units receiving building permits have been in Salt Lake City (13,400 units), and 24% have been in Salt Lake City’s downtown (7,500 units). Of the 18 cities in Salt Lake County, only one other accounted for more than 10% of new apartment construction, Sandy City, with an 11% share.

Despite high levels of construction, vacancy rates fall, and rental rates climb – Since 2002, Cushman & Wakefield has published a local rental and vacancy rate report for Salt Lake County. The 2021 (August) report shows a vacancy rate of less than 2% for all types of rental units, from studios to three-bedroom units. This is the lowest vacancy rate in the 20-year history of the report. In 2021, rental rates increased by 10.1%, the second-highest yearly increase in the history of the report.

Strong demand and higher rents create greater cost burdens for renters – According to HUD’s Comprehensive Housing Affordability Strategy (CHAS), the share of renters with housing cost burdens doubled from 2009 to 2018 (the most recent data available). In 2009, 20% of renter households in Salt Lake County (19,760 households) faced a housing cost burden (paying 30% or more of their income for housing and utilities). By 2018, the share had increased to 41%, nearly 60,000 renter households.

Countywide vacancy rate expected to increase to 5.7% by 2024 – Given the number of units under construction and proposed, the Salt Lake County rental inventory will increase by 18,167 units over the next three years. Assuming annual renter household growth continues at 2.6% (2010–2021 average), the number of renter households will increase by 11,700 in three years. As sky-high home prices disqualify more households from homeownership, it’s doubtful, barring a severe recession, that the annual growth rate will fall below the 11-year average of 2.6%.

The full study is now available online.

###