Blog Post

Insight: Homeownership Rates for Young Households Are Declining

By: James Wood

In the early 1970’s, I was a graduate student and my wife a school teacher. We had limited income and a limited credit history but our bank had no worries about loaning us $5,000 ($29,000 in today’s dollars) for a building lot in Salt Lake County. A few years later, we had a home built and became homeowners. We were in our early thirties and compared to most of our friends latecomers to homeownership. At least in retrospect, the shift from renter to homeowner seemed a natural and relatively stress-free transition. Economic conditions, despite comparatively high interest rates, were favorable for young households to move into homeownership, quite a contrast to today’s housing market. Now, even with very low interest rates, qualifying for homeownership is a much bigger challenge for young households.

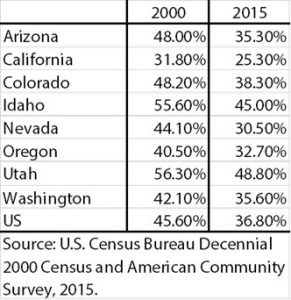

Homeownership rates for young households have fallen in every state and in some states precipitously. The Great Recession, high housing prices, the burden of student debt, weak income growth, bank lending restrictions, and changing housing preferences are all factors affecting rates of homeownership. In Nevada, the homeownership rate of young households dropped from a 44 percent share in 2000 to only 30 percent in 2015. In California, only one in four young households was a homeowner in 2015. The decline in Utah has been more modest with homeownership for the millennial generation—25-34 years old—dropping from 56 percent to 49 percent. Despite this decline, the 49 percent in Utah is the highest homeownership rate of any western state shown in Table 1.

Perhaps a good share of the decline in the rate of homeownership for young households is due to changing preferences of the millennial generation. A lot has been written about the millennials more “footloose and free” approach to housing. While a majority of millennials rent, most, anticipate owning their own home. A 2015 survey by the Urban Land Institute found that 70 percent of millennials anticipate owning a home within five years. Converting this anticipation into actual homeownership will determine whether the troubling decline in homeownership rates is a temporary phenomenon or a long-term trend. A trend with economic implications for home builders, realtors, landlords, and ultimately household wealth.

Table 1

Homeowners as Percent of Households by Age, 25-34 Years

James Wood is the Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute.