Blog Post

Insight: What Does the COVID-19 Pandemic Mean for Utah’s Housing Market?

By: James Wood

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Jun 10, 2020 – For over 40 years, I have made an annual forecast of Utah’s housing market. Never have the economic conditions underlying my forecast been as uncertain and fast-moving as the COVID-19 market, due to the extreme volatility expected in Utah’s job market over the next several months. The good news is that in the second half of the year employment growth returns, bringing the 2020 annual employment estimate to 1,529,000 jobs, down only 31,000 jobs from 2019. The unemployment forecast for 2020 is 5.3%, much lower than the peak unemployment rate of 8.1% during the Great Recession.

This housing forecast assumes job recovery by the fourth quarter, which of course also assumes the economic recovery will be preceded by near containment of COVID-19 through testing, treatment, and isolation of cases, however, much uncertainty remains regarding the virus.

Residential Construction

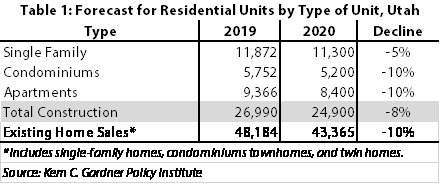

I expect the number of residential permits in 2020 to fall by about 8%, a decline of 2,600 units. Economic contractions cause buyers and sellers to head for the sidelines. The suddenness, severity, and uncertainty of this downturn will cause some developers and buyers to postpone transactions that would have occurred in the spring and summer of 2020. Another factor that could hamper residential construction is disruption in the construction industry supply chain. China supplies 30% of construction materials. Furthermore, the approval process for new developments will likely be extended as city and county personnel work remotely.

Single-Family Construction—There were no signs in 2019 that the single-family market was overbuilt. The number of new homes receiving building permits statewide was 11,900, slightly below 2017 and 2018, and still 43% below the pre–Great Recession peak of 20,950 units. Homebuilders reported strong demand for their product, and they held little in the way of speculative inventory. The single-family market, however, will not be insulated entirely from market headwinds. The initial shock of the economic shutdown, combined with social distancing will slow new construction activity and sales, particularly in the second quarter. For the year, the number of permits issued for single-family homes will be down 5%, a much smaller decline than the 45% drop in the fourth quarter of 2008, in the immediate wake of Lehman Brothers’ collapse and the onset of the Great Recession. The steep decline of single-family activity in 2008 was due to credit markets seizing-up. Credit was not available for most borrowers; only those with gold-plated FICO scores could secure home loans. Credit conditions are very different today. Credit is available, and mortgage rates are near historic lows. This critical distinction will cushion the downside for the new single-family market.

Condominium and Townhome Construction—The number of permits issued for condominium and townhome units accelerated in recent years, reaching a record high of 5,752 units in 2019. The investor market drove some of the recent surge in demand. Hundreds of condominium and townhome units over the past few years have been sold to investors buying three to four units to rent. Investors are unlikely to have the same appetite for rental units during a stock market correction and historic job losses. A pullback by investors will cut into demand, and buyer interest will probably fade some as well. The young, moderate-income household is the primary target market for condominiums, and these households are more vulnerable to the uncertainties of the job market and more likely to postpone home-buying decisions, either by choice or necessity. Weaker demand from investors and buyers will shave 10% off the number of condominium and townhome permits in 2020.

Apartment Construction—Last year, the number of permits issued for apartment units hit an all-time high of 9,366, almost 40% more than the second-highest year on record, 2016. Even without COVID-19, apartment construction was likely headed lower in 2020. Given the current environment, some developers will delay potential projects due to weaker market conditions as well as less advantageous financial markets, thereby pushing apartment construction activity lower. The number of permits issued for apartment units will experience a drop in activity in 2020, falling by 10%.

Existing Homes Sales

While not as vulnerable as the homebuilder, real estate agents will face similar challenges: extreme market uncertainty and reluctant buyers and sellers. So far, financial market liquidity has not been affected by COVID-19; in fact, the pandemic has kept mortgage rates near historic lows. The performance of the residential real estate market in 2020 comes down to whether economic uncertainty offsets the advantage of low interest rates. A share of both potential buyers and sellers will feel it’s to their advantage to wait six to 12 months before entering the market, while others will see the current market as a buying opportunity. However, the impossible-to-ignore job losses could seriously dampen demand in the second quarter. But, as the economy recovers in the second half of the year, strong demand for homes will follow, and sales of existing homes, condominiums, and townhomes will finish the year down 10%. Last year sales totaled 48,184 units. In 2020, total statewide sales will be around 43,400 units. Much of the decline, however, will be due to fewer listings, which reduces the “for sale” inventory.

Home Prices and Rental Rates

Home prices will continue to increase, but at a slower pace. The shortage of listings will put upward pressure on prices. Statewide, the median sales price of a home (single-family, condominiums, and townhomes) will increase by about 5% to $336,000 in 2020. Rental rates are more likely to decline as job and income losses force some tenants to move out and double-up with friends and family. According to the Commerce Real Estate Solutions’ annual market survey, rental rates in Salt Lake County have been increasing at an average annual rate of 5% since 2011. The long string of annual rate increases will be interrupted in 2020, with rents flat at best and possibly falling 3% to 4%.

Rental Market

The rental market is bound to see higher vacancy rates. Over the last four or five years, the vacancy rates in Wasatch Front markets have consistently been below 4%. In recent months, however, rates had started to move higher due to the completion of several new projects. The increasing supply of rental units, combined with a rising unemployment rate, will put pressure on the market and inevitably push vacancy rates higher.

The rental market is particularly vulnerable to recessions, but fortunately the CARES Act, through the expansion of unemployment insurance, will shield many landlords and renters, at least for a while, from a major loss in revenue and tenants. Renters impacted by COVID-19 were also protected from eviction by Governor Herbert’s Executive Order of April 1st, which provided a statewide moratorium on evictions until May 15th. Vacancy rates throughout the Wasatch Front are currently between 5% and 6%. I expect rates to move up 1 to 2 percentage points, as recently completed projects experience slow rates of absorption, and existing projects see an increased rate of move-outs.

Housing Market Forecast 2020

The COVID-19 recession will cut residential construction and existing home sales by 8% to 10%, depending on the type of housing. Single-family construction will be least affected with only a 5% decline, while the numbers of building permits issued for apartments and condominiums as well as the sales of existing homes are expected to decline by 10%.

James Wood is the Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute.