Blog Post

Insight: How Is the Current Health Crisis Impacting Utah’s Real Estate Market?

By: Dejan Eskic

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

May 27, 2020 – The success of a strong real estate market is solely dependent on tenants’ ability to pay rent. As we began 2020, no one could have predicted that by April roughly half of retail tenants would miss rent payments, the majority of offices would shift to our homes, and that we would have executive orders putting a moratorium on evictions. Every real estate sector has suffered.

Utah’s housing market started the year off strong, having its best Q1 on record in terms of permitted new units. However, April data showed just how severe inventory slumped. Construction of new homes fell nearly 45% compared with last April, while the number of existing homes sold fell nearly 25%. This decline in inventory is likely to aggravate Utah’s housing shortage. The pent-up demand has continued to keep price growth positive, with April experiencing a 6.3% increase over last year. Apartment rents increased about 1% this April compared with last. There are approximately 5,500 new apartments under construction currently. The increasing supply of rental units, combined with the expected loss of nearly 300,000 jobs in the second quarter, will put serious pressure on the rental market and inevitably push vacancy rates higher.

The commercial real estate sector is taking the brunt of the economic impact as restaurants have closed, hotel rooms go unoccupied, offices are empty, and manufacturing has slowed. This is evident in the unemployment insurance claims data. Approximately 10% of Utah’s workforce has filed for unemployment insurance when compared with the February employment total. This unemployment translates to empty real estate.

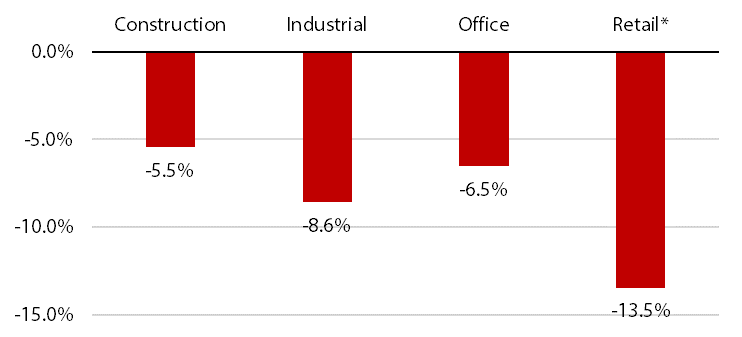

Figure 1 shows the share of employees filing for unemployment insurance as classified by real estate building type, plus construction. Retail-building employees had the largest share of unemployment claims, with 13.5% of workers filing. Office-using jobs saw 6.5% of the workforce file for unemployment, while 8.6% of employees in industrial buildings filed. The construction sector has seen 5.5% of its workforce file for unemployment.

Figure 1: Share of Unemployment Claims by Property-Using Sector,

Cumulative Through Second Week of May 2020, Utah

Note: Unemployment claims compare total filings to February jobs numbers.

*Includes Retail and Accommodation & Food Service

Source: Kem C. Gardner Policy Institute

The industrial sector is likely to have a renaissance as quarantine orders have accelerated a larger shift to online shopping, leading to more demand for warehouses and storage. The office sector is likely to see two outcomes. First, some companies are realizing that working from home is effective and are closing offices. Nationwide Insurance recently announced it will permanently switch to work-from-home in some of its smaller markets. Second, we are likely to see an increase in demand for office space in some markets as space per employee is likely to increase as a result of social distancing. The retail sector faces the toughest challenge. Brick and mortars have been shutting down locations for the past few years, and we are likely to see more as a result of the current challenges. Those who are financially stable and able to innovate will survive.

While April was brutal not just for real estate but for the whole world, optimism is returning as restrictions are lifted. The future of real estate is about adapting and offering not just the best price but a safe and healthy environment.

Dejan Eskic is a senior research analyst at the Kem C. Gardner Policy Institute.