Blog Post

Insight: Housing in 2020: What a Long, Strange Trip it’s Been

By: Dejan Eskic

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

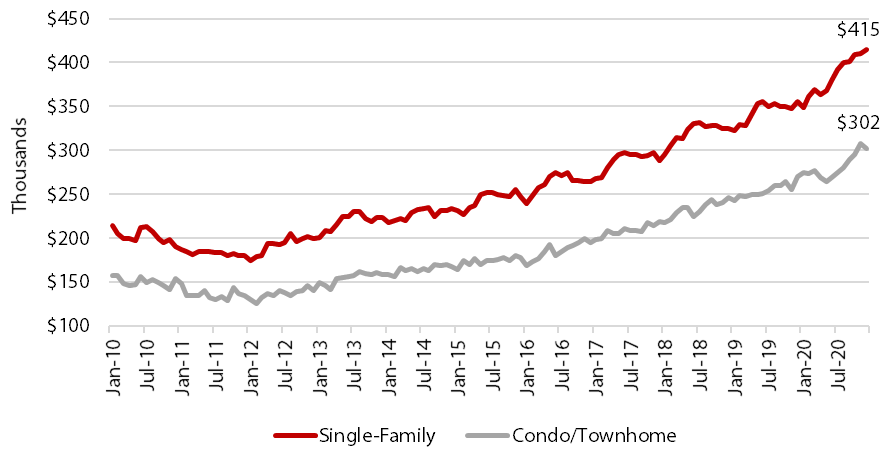

Jan 19, 2021 – A surge of buyers and historically low interest rates, combined with a record drop in housing inventory and a global pandemic ravaging its way through the economy, led Utah’s housing market to new heights in 2020. The year ended with a record number of new permitted units, passing the 30,000 milestone. The single-family median sales price broke the $400,000 mark and the condo/townhome median sales price broke into the $300’s (see Figure 1).

Figure 1: Utah Median Sales Price, 2010–2020

Source: PowerdByUtahRealEstate.com

So what was difficult about 2020 for housing? Our recent Survey of Utah’s Top Homebuilders sheds light on some of these difficulties. As customers locked in prices for new homes, material prices increased during the construction process, cutting into profits and pushing up the price for the next buyer. Random shortages of dishwasher screws, windows, or tile grout were eclipsed by the drastic surge in lumber prices.

Construction crews had to deal with the pandemic at the jobsite. Builders that faced COVID-19 exposures on construction sites forced crews to quarantine. While the crews were in quarantine, labor shortages made it difficult for some builders to find replacement workers.

The majority of issues faced in 2020 can be put into one word – delays. These delays, combined with record demand, are forcing some builders to cap the number of homes they can build in order to deliver the project on time.

The outlook for 2021 is cautiously optimistic.

The Positive – The steady demand for new housing and Utah’s economic strength are the driving factors for a positive outlook from the builders we surveyed. An increase in in-migration and low interest rates continue to be a positive for homebuilding, incentivizing buyers to purchase new homes.

The Negative – 2020 brought many challenges. While the escalation in price would be perceived as a positive, it was driven by a surge in material costs and material shortages. Many builders feel that the current price appreciation is unsustainable and that the market is “running out of room” for further price growth.

The Uncertainty – The current outlook for interest rates shows them remaining low for some time. However, builders worry that as the economy recovers interest rates may rise. As material prices continue to drive home price growth, an increase in rates would have the potential to slow the market.

This long, strange trip will likely continue in 2021.

Dejan Eskic is a senior research fellow at the Kem C. Gardner Policy Institute.