Blog Post

Insight: Finally, Some Good News on Health Care Costs

By: Laura Summers

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Jan 30, 2020 – When you hear the term “health care costs,” it is typically never associated with good news. In an earlier blog post, I noted that surprise medical bills, the rising cost of prescription drugs, and a lack of price transparency in the health care market have long frustrated the public and have policymakers looking for solutions. And while our collective pocketbooks have all experienced the squeeze of rising health care costs, a recent report from The Commonwealth Fund provides some good news for Utahns with employer-sponsored insurance.

Using data from the Medical Expenditure Panel Survey–Insurance Component (MEPS–IC),[1] the Commonwealth Fund found that employer premiums (including contributions from employers and employees) rose by 4.9% annually for single plans and 5.1% annually for family plans between 2016 and 2018. This increase follows a decline in average annual premium cost growth from 2008‒2016.

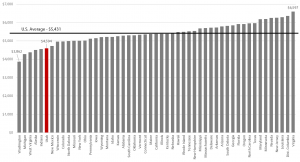

So what is the good news about rising premiums and deductibles? Well for one, the data show that employees in Utah have the sixth lowest premium contribution in the nation for both single and family health insurance plans ($1,183 and $4,594, respectively). Our ranking on deductibles is even better. We ranked third lowest in terms of average deductibles for single-person health plans ($1,451).

Figure 1: Average Annual Employee Premium Contribution for Family Coverage, by State, 2018

Note: Employee premium contributions are for insurance policies offered by private-sector employers in the U.S.

Data: Medical Expenditure Panel Survey–Insurance Component (MEPS–IC), 2018.

From Trends in Employer Health Care Coverage, 2008–2018: Higher Costs for Workers and Their Families. (2019 Nov.) The Commonwealth Fund.

This is important given that the majority of Utahns receive health care coverage through their employers. Utah has the highest rate of employer-sponsored insurance (ESI) in the nation. More than 61.0% of Utahns have ESI compared with the national average of 49.0%.[2]

And while it’s helpful to know how our premiums and deductibles compare with other states, it’s more important to know how these numbers compare with how much we make.

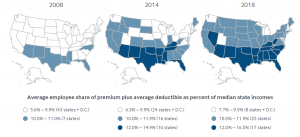

The second piece of good news is that the amount of premiums and deductibles employees pay compared to household income is also low in Utah (ranking 49th and 45th, respectively). In terms of growth over time, Utah’s average employee premium contributions as a percent of state median household income grew only 1.2 percentage points between 2008 and 2018 (14th slowest), and average employee deductibles as a percent of state median household income grew by 1.3 percentage points (fourth slowest).

Overall, the report shows that Utah employees have low health insurance costs despite having a high median household income.[3] Data used in the Commonwealth Fund report show we rank seventh highest, with a median household income of $77,000 in 2018. This high income, combined with low employee premium contributions and deductibles, means that, on average, Utahns with employer-sponsored insurance are spending a lower portion of their income on health insurance costs compared with the rest of the country. In 2018, we were one of only eight states plus D.C. where average employee premium contributions plus deductibles was less than 10% of median household income.

Figure 2: Average Employee Premium Contributions and Deductibles Exceeded 10% of Median Income in 42 States by 2018

Note: Combined estimates of single and family premium contributions and deductibles are weighted for the distribution of single-person and family households in the state.

Source: Premium contributions and deductibles — Medical Expenditure Panel Survey–Insurance Component (MEPS–IC), 2008–2018; Median household income and household distribution type — analysis of the Current Population Survey (CPS), 2008–2019, by Ougni Chakraborty and Sherry Glied of New York University for the Commonwealth Fund.

From Trends in Employer Health Care Coverage, 2008–2018: Higher Costs for Workers and Their Families. (2019 Nov.) The Commonwealth Fund.

At a time when health care costs continue to rise, this is good news for our state. While the numbers represented in this report are averages, they show that Utah is maintaining better levels of employer-sponsored health insurance affordability compared with most other states.

Laura Summers is the senior health care analyst at the Kem C. Gardner Policy Institute.

[1] MEPS–IC surveyed more than 40,000 private-sector employers in 2018 on their health insurance plans.

[2] Kaiser Family Foundation estimates based on the Census Bureau’s American Community Survey, 2008-2018.

[3] Median income is measured for all households under age 65.