Blog Post

Insight: Federal Economic Stimulus Efforts

By: Phil Dean

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Apr 30, 2021 – Since the Great Depression nearly a century ago, the U.S. Congress and President have used fiscal policy (taxing and spending powers) and the Federal Reserve has used monetary policy (influencing interest rates through control of the money supply) in an attempt to counteract economic declines. Over the past year, both fiscal and monetary policy tools were deployed on a massive scale to counteract the pandemic recession.

These massive federal efforts initially propped up the faltering Utah economy during the most severe pandemic-induced economic impacts in March and April of 2020, and have facilitated the significantly strengthened economy that Utah enjoys today. As additional federal resources arrive in Utah in the midst of a top-performing economic recovery, Utah families, businesses, and state and local governments have a unique opportunity to wisely invest these resources for long-term prosperity.

U.S. Monetary Policy

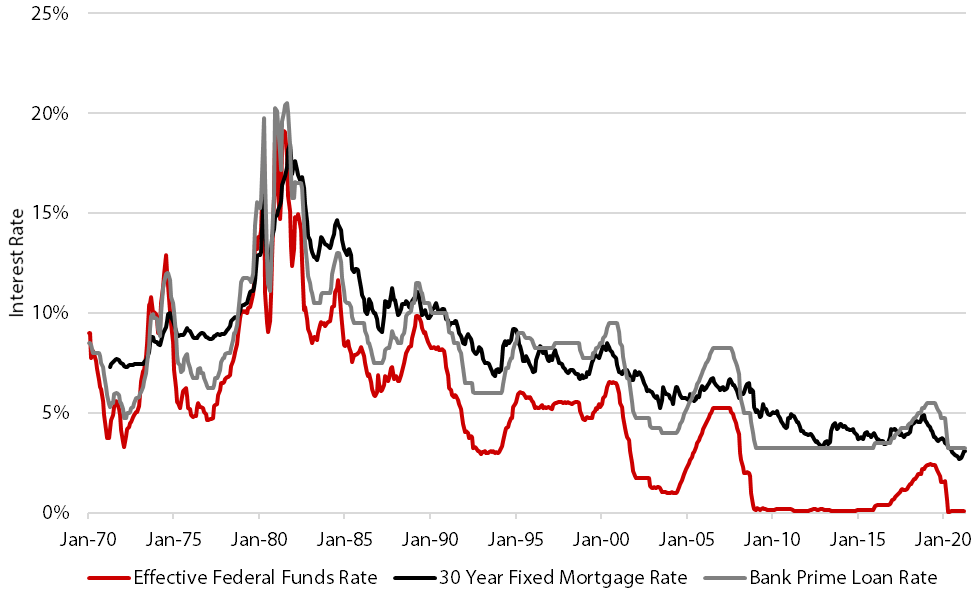

As the pandemic recession took hold, rapid expansionary monetary policy efforts by the Federal Reserve stabilized shaky financial markets and led to reduced interest rates, propping up languishing economic activity (see Figure 1).

Lower interest rates encourage more economic activity by reducing interest costs on financed goods. For example, when mortgage interest rates drop, this directly encourages more homebuying (and homebuilding), as more buyers can purchase a higher-priced house while keeping the same monthly payment. Moreover, when existing homeowners refinance their mortgage to a lower interest rate, those interest savings permanently free up disposable income that can be spent elsewhere in the economy or saved. Similarly, business costs for financed equipment or buildings also drop as interest rates drop.

Figure 1: Selected U.S. Interest Rates

Source: Board of Governors of the Federal Reserve System, Freddie Mac; retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/

Three Phases of Federal Fiscal Response

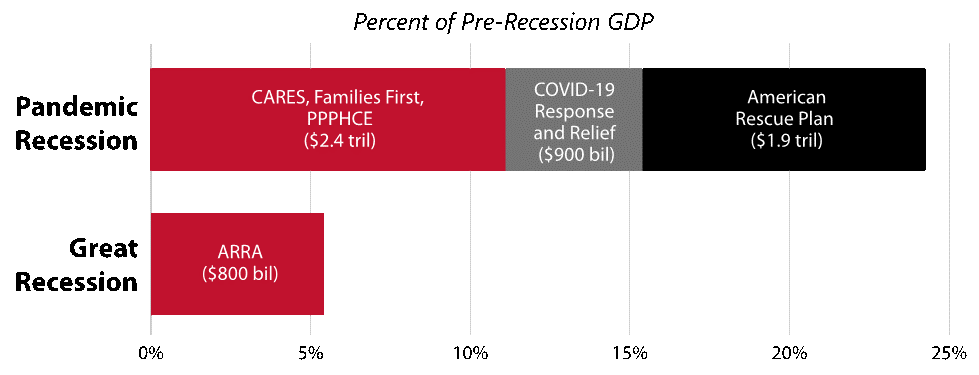

In addition to the Federal Reserve’s monetary policy actions, as the pandemic recession took hold in March 2020, the federal government provided historic levels of expansionary fiscal stimulus to offset pandemic-induced reductions in economic activity. Subsequent bills have provided additional historic levels of fiscal stimulus.

The $5.2 trillion in federal fiscal response during the pandemic recession can be summarized in three phases:

- $2.4 trillion in March and April 2020 through the Families First Coronavirus Response Act; the Coronavirus Aid, Relief, and Economic Security (CARES) Act; and the Paycheck Protection Program and Health Care Enhancement Act;

- $0.9 trillion in December 2020 through the Coronavirus Response and Relief Supplemental Appropriations Act; and

- $1.9 trillion in March 2021 through the American Rescue Plan Act.

As shown in Figure 2, this response level dwarfs what was considered a very large federal fiscal policy response during the 2008–10 Great Recession.

Figure 2: Federal Fiscal Stimulus Compared with Pre-Recession GDP

Source: Kem C. Gardner Policy Institute estimates based on data from the Congressional Budget Office, Moody’s Analytics, and Committee for a Responsible Federal Budget

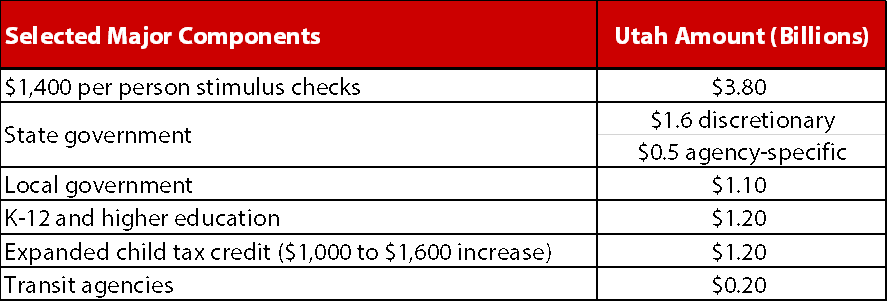

As the following table shows, just the largest components of the recently enacted American Rescue Plan Act are projected to provide about $9.6 billion to Utah. As funds flow into the state from the smaller funding pieces, this number will likely exceed $10 billion.

Table 1: American Rescue Plan Act Funds Delivered to Utah

Source: Kem C. Gardner Policy Institute, Utah State Tax Commission, Utah Governor’s Office of Planning and Budget, and Federal Funds Information for the States (FFIS)

Looking forward, with the massive amount of discretionary funds coming to households, firms, and governments in the state, Utahns have a major opportunity to use these one-time funds to achieve permanent benefits. At the same time, with Utah’s economic recovery well underway and much stronger than the nation’s recovery, it will be important to keep an eye on how decisions for use of these funds impact the overall economy, particularly as inflationary concerns already exist in some sectors such as construction.

Phil Dean is the public finance senior research fellow at the Kem C. Gardner Policy Institute.