Blog Post

Insight: A Poorly Timed Price War

By: Thomas Holst

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

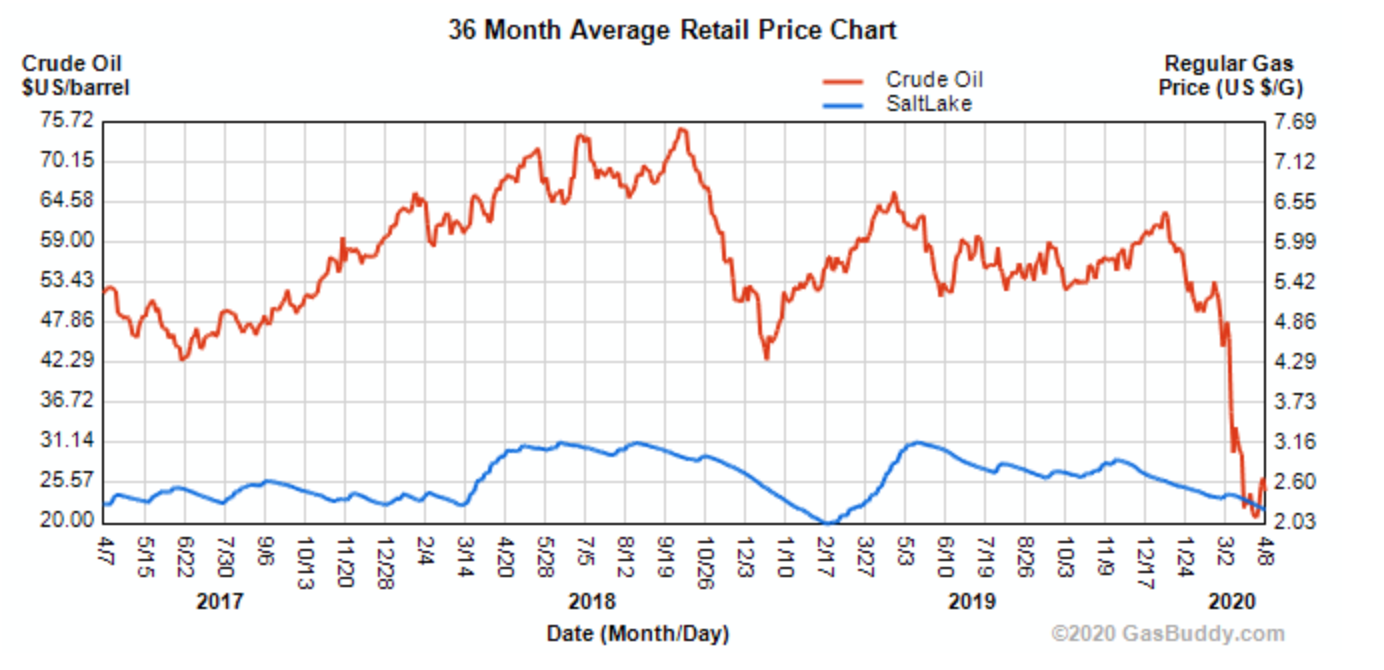

Apr 27, 2020 – Utah motorists have recently enjoyed a significant drop in the cost of tanking up their automobiles. Since March 3rd, the average price for a gallon of regular has fallen from $2.45 to $2.10 in Salt Lake and from $2.41 to $1.82 nationally.[i] This price drop is due to global crude oil supply and demand fundamentals. Understanding these market fundamentals provides clues on how long these favorable prices may continue.

Supply fundamentals were impacted by a rift between Russia and Saudi Arabia, the world’s second- and third-largest crude oil producers respectively. After the Organization of Petroleum Exporting Countries (OPEC) failed to reach agreement in early March on crude oil production levels, Russia and Saudi Arabia each ramped up production levels, sending global oil markets into a free-fall with prices slumping by 60% as crude oil supply overwhelmed demand.

Figure 1: Average Crude Oil Price vs. Salt Lake City Gasoline Price, April 2017–April 2020

Both Russia and Saudi Arabia wanted to protect their share of a global crude oil market that brings in hard currency, supporting government budgets. The plan of these two oil giants backfired because crude oil prices are expected to eventually bottom out at a range of $10–$20 per barrel, which corresponds to the incremental crude oil production cost for both countries.

Demand fundamentals for crude oil are also under pressure due to restricted movement of people complying with government COVID-19 quarantine and social distancing policies. The resulting lower transportation and industrial energy requirements have significantly reduced demand.

Why did OPEC miscalculate, given that prior OPEC actions have sent global energy prices soaring? First, the USA, with the largest global economy, has transformed itself into the world’s largest crude oil producer for the first time in decades,[ii] relying on imports only to a small degree. Second, Saudi Arabia and Russia underestimated diminished global energy demand caused by COVID-19.

What impacts will be felt in Utah? First, lower global crude oil prices may negatively impact Uinta Basin energy companies that have high crude oil production costs. These companies may be unable to survive an extended period of low oil prices. Potential outcomes include: 1) industry consolidation as larger Uinta Basin companies acquire smaller companies to achieve economies of scale, or 2) companies curtail unprofitable operations and reduce headcount.

Second, the good news is national average retail prices for regular gasoline are forecasted to be $1.58 per gallon during the 2020 summer driving season.[iii] The bad news is that during a viral outbreak, consumer fuel savings may not translate into increased spending on activities restricted by social distancing.

When OPEC reconvenes to assess their predicament, they may invoke Walt Kelly’s maxim, “We have met the enemy and he is us.”

Thomas Holst is the senior energy analyst at the Kem C. Gardner Policy Institute.

[i] https://www.gasbuddy.com/Charts; accessed April 22, 2020.

[ii] Visual Capitalist, “The Largest Producers of Crude Oil, 1965–2019”; https://www.visualcapitalist.com/the-largest-producers-of-crude-oil-1965-2017/

[iii] United States Energy Information Administration, Short Term Energy Outlook, “2020 Summer Fuels”; https://www.eia.gov/outlooks/steo/special/summer/2020_summer_fuels.pdf