Blog Post

Insight: The Little Engine that Could

By: Thomas Holst

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Aug 2, 2021 – Shareholder pressure is forcing a global oil and gas company to reduce its carbon footprint.

ExxonMobil (XOM) shareholders elected three climate activists from a small hedge fund, Engine No. 1, to the 12-person board of directors. BlackRock, Inc., the New York State pension fund, and two California pension funds exercised Environment Social Governance (ESG) principles to seat three climate activists from Engine No. 1 on XOM’s board. Rarely does a highly capitalized company like XOM ($250 billion) have one dissident director, let alone three.

A week before the XOM shareholder meeting, the International Energy Agency issued a report recommending investors stop funding fossil fuel projects so that the 2015 Paris Agreement on climate change targets may be reached. The Paris Agreement targeted an 80% reduction of 2050 carbon dioxide emissions versus 2005 levels in order to limit global temperature increases.

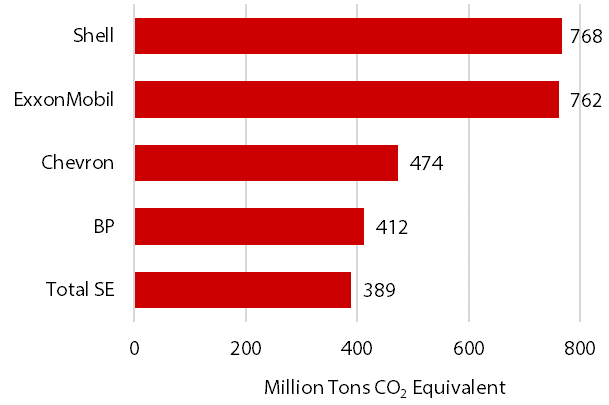

The XOM board member election confirms the influence of ESG shareholders who give equal weight to financial performance and climate strategy. However, in XOM’s case, financial performance and climate strategy have both been poor. Regarding climate strategy, XOM has been one of the largest emitters of carbon amongst its peer companies (see Figure 1).

Figure 1: Annual Greenhouse Gas Emissions by Major Oil and Gas Companies

(2020 or latest available)

Source: Bloomberg and ExxonMobil

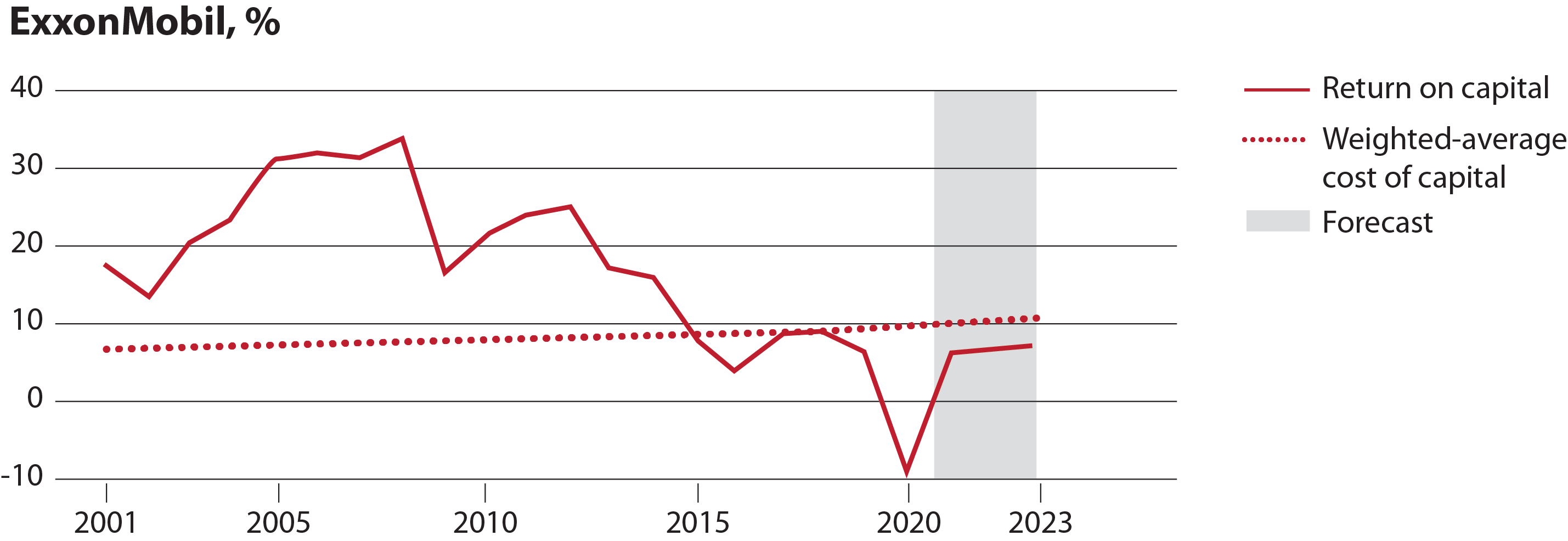

Once known for prudent capital spending, XOM’s return on capital since 2015 has been below its weighted-average cost of capital (see Figure 2).

Figure 2: ExxonMobil Return on Capital, 2001–2023

* Estimated from debt and equity

Sources: ExxonMobil, JPMorgan Chase, Refinitiv Datastream

Large XOM shareholders include BlackRock (6.7%), Vanguard (8.2%), and New York and California pension funds (combined 1%). The XOM board of directors shuffle verifies a statement by Larry Fink, BlackRock CEO, that “climate risk is investment risk, but climate transition presents a historic investment opportunity.” Three new XOM board members will now have an insider’s view on XOM’s environmental stewardship measures.

Pension funds traditionally hold oil and gas shares to reap steady dividend streams. How important are dividends for pension funds? When I worked at Chevron during the 2014 crude oil price slump, Chevron borrowed money in order to pay full dividends to its shareholders. However, pension funds have now adopted a new criterion—environmental stewardship.

On the same day as the XOM shareholder meeting, the Hague District Court in The Netherlands ordered Shell to slash its worldwide greenhouse gas emissions 45% by 2030 from 2019 levels on grounds that Shell violates human rights by contributing to global warming.

Both developments reflect a unity between ExxonMobil shareholders and the Hague District Court on environmental stewardship.

Thomas Holst is the senior energy analyst at the Kem C. Gardner Policy Institute.