Blog Post

Insight: The Good, The Bad, and The Ugly: Addressing Utah’s Short Term Rental Market Growth

By: Jennifer Leaver

Apr 19, 2022 – Short term rentals, available on platforms like Airbnb and VRBO, have drawn both positive and negative attention over the past few years. Initially, short term rentals were lauded as income-generators that allowed local residents to rent out their personal spaces and properties to visitors. In fact, during the COVID-19 pandemic, short term rentals were perceived by travelers as “safer” accommodation alternatives to hotels. However, short term rentals have generated controversy as neighborhood disruptors and key contributors to local and employee housing shortages.

So, what does Utah’s short term rental market look like, where do renters originate, and what are Utah’s short term rental hotspots?

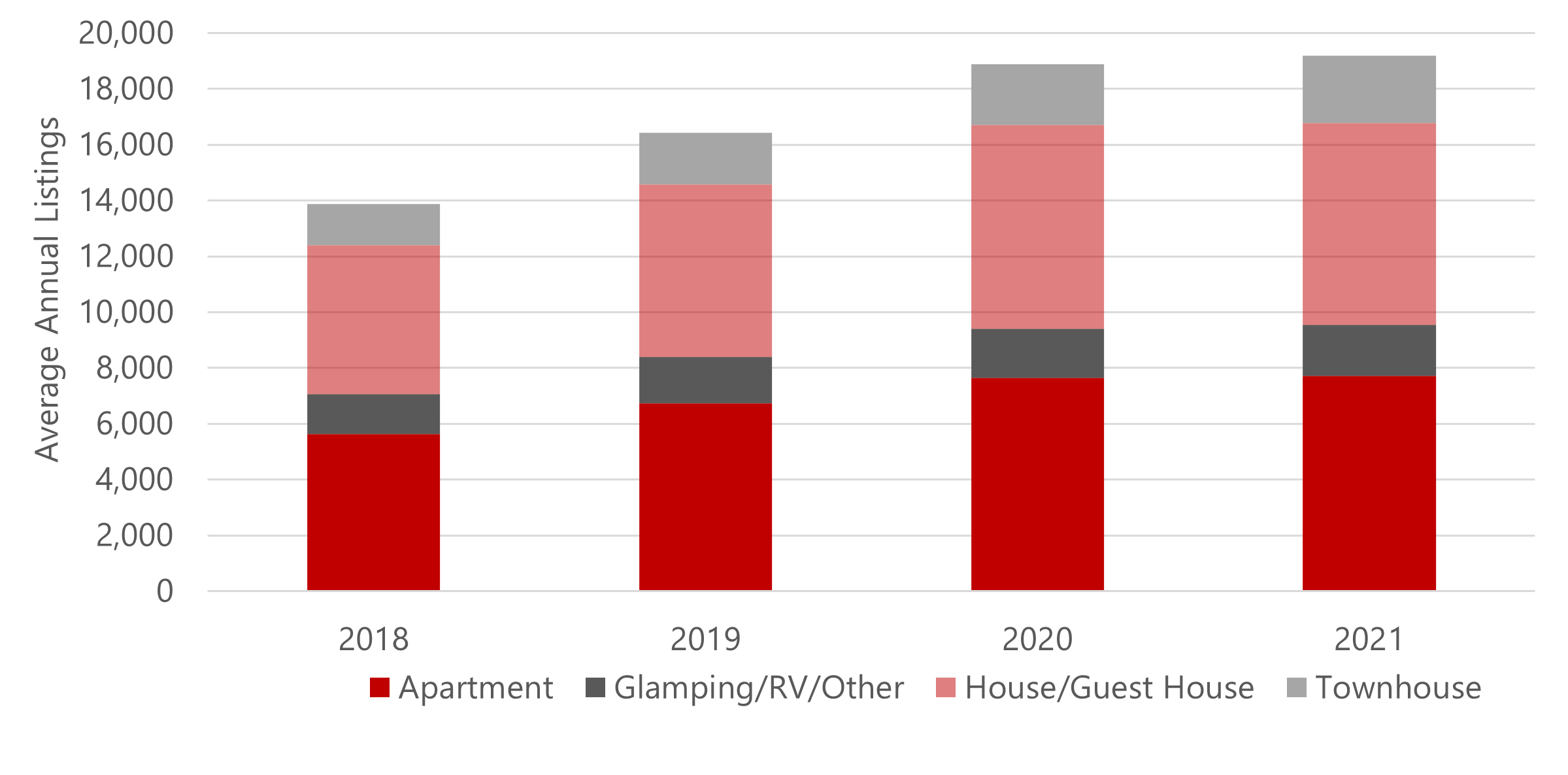

According to Transparent, Utah has experienced a 38.4% increase in short term rental listings over the past four years (see Figure 1). When broken down by listing type, listings were predominantly houses (40.2%) and apartments (37.7%), followed by townhouses (12.5%) and other accommodations, such as glamping, RVs, and other unique rental units (9.5%)—a breakout that has remained consistent over the years.

Figure 1. Average Annual Short Term Rental Listings in Utah by Type, 2018-2021

Note: Data represents average annual listings; rental types “bed and breakfast,” “dorm,” and “other” have been omitted; rental types include both rental of the entire unit (i.e., house, apartment, townhouse, etc.) and individual rooms within the unit.

Source: Kem C. Gardner Policy Institute analysis of Transparent data

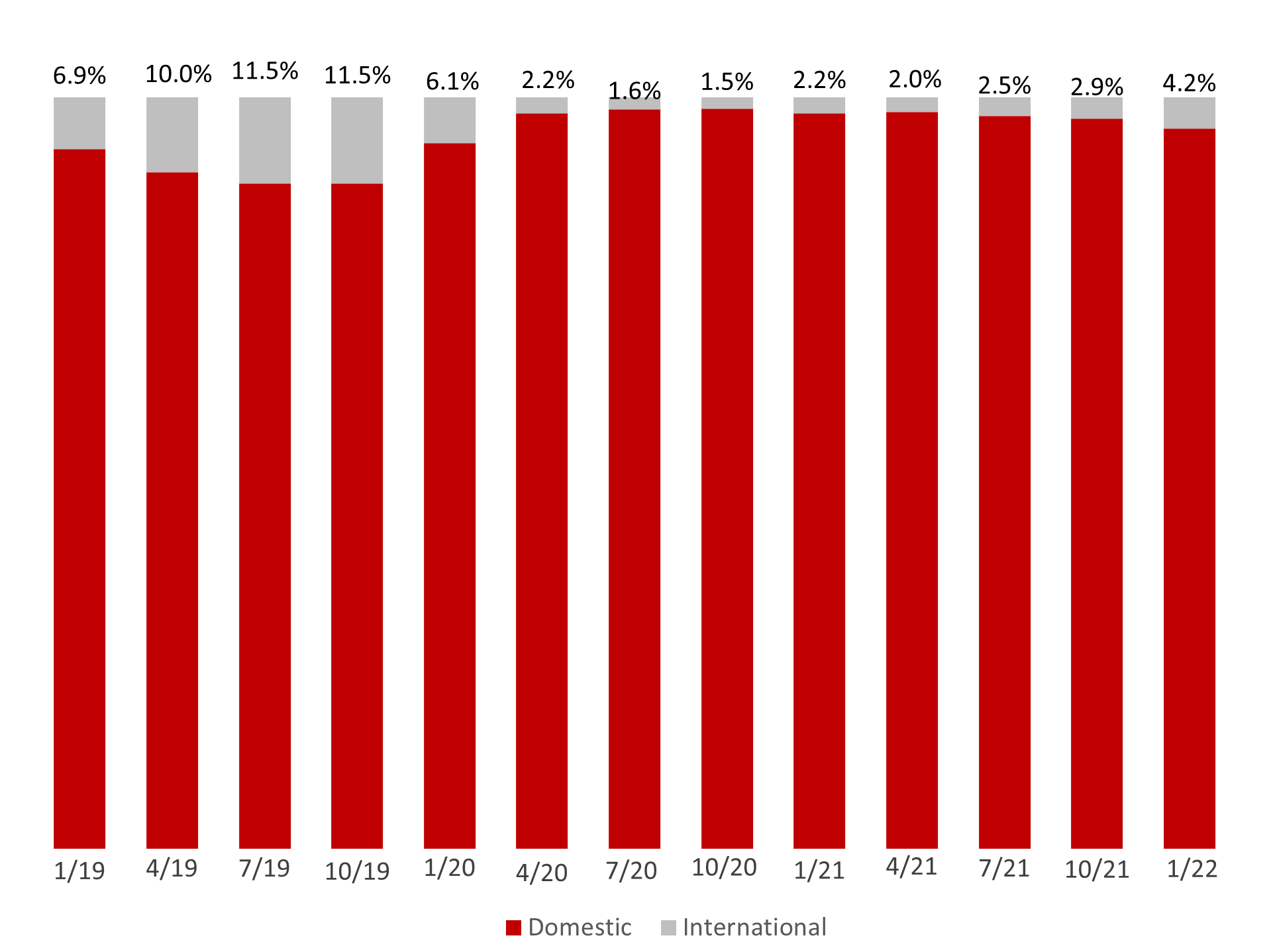

Because the majority of short term rental data is captured on a couple of major online platforms, collecting short term renter demographic information is possible. Renter origin data shows the pandemic-influenced drop in international visitation in April 2020 and its gradual return beginning in July 2021 (see Figure 2). As for domestic renters, Transparent reports one third of Utah’s domestic visitors are from in-state, another third are from California, and the remaining third hail from Nevada, Texas, New York, Colorado, Arizona, and Idaho.

Figure 2. Domestic vs. International Shares of Utah Short Term Rental Occupants, January 2019 through January 2022

Source: Kem C. Gardner Policy Institute analysis of Transparent data.

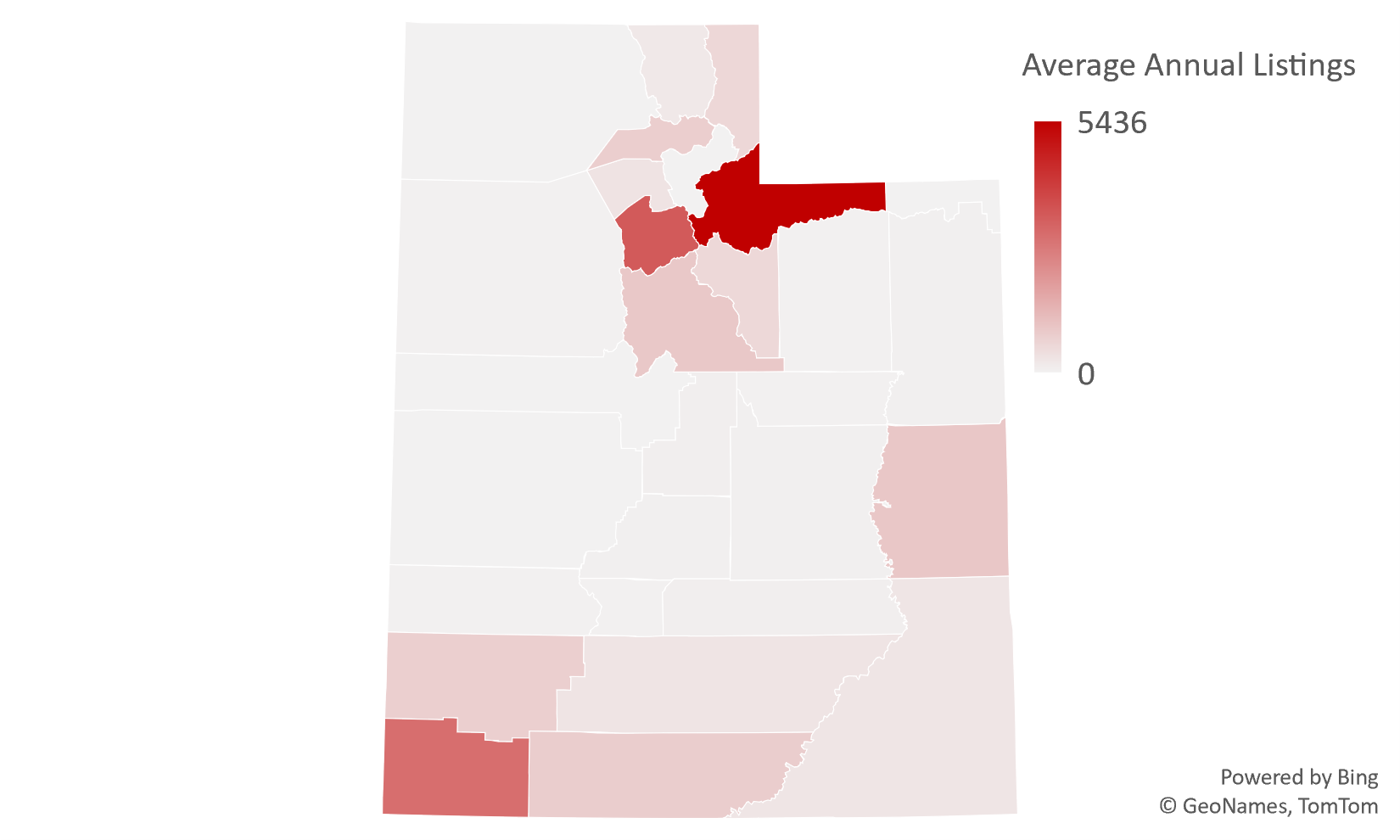

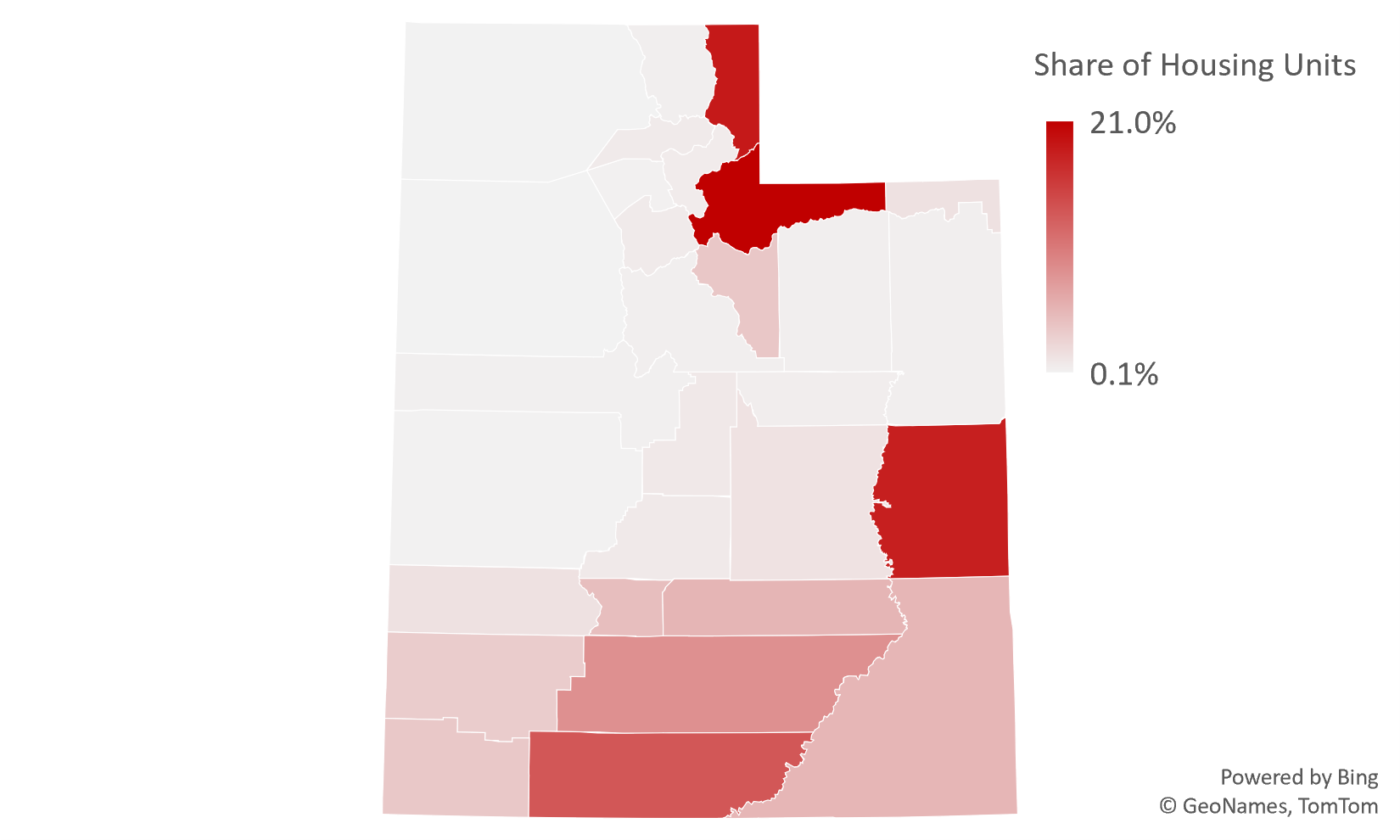

Finally, Utah’s short term rental hotspots are spread across the state. In terms of listing numbers, Summit, Salt Lake, and Washington counties top the list (see Figure 3). However, when put into the context of listings as shares of total housing units, Summit, Rich, Grand, and Kane counties stand out, as does the southern third of the state, pointing to potential problem areas when it comes to local housing shortages (see Figure 4).

Figure 3. Average Monthly Short Term Rental Listings by County, 2021

Note: Data represents average annual listings; rental types “bed and breakfast,” “dorm,” and “other” have been omitted.

Source: Kem C. Gardner Policy Institute analysis of Transparent data

Figure 4. Short Term Rental Listings Shares of Total Housing Units, by County, 2021

Note: Data represents average annual listings; rental types “bed and breakfast,” “dorm,” and “other” have been omitted.

Source: Kem C. Gardner Policy Institute analysis of Transparent and U.S. Census Bureau data

It is likely that short term rentals will continue to elicit a diversity of opinions, from renters that benefit from the additional income and travelers that prefer Airbnbs to hotels, to community members that dislike frequent guest turnover and local governments trying to tackle housing crunches. As a result, I anticipate that we will continue to see a growing body of legislation and local policies addressing short term rental regulations, particularly in the Utah’s tourism areas.

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Jennifer Leaver is the senior tourism analyst at the Kem C. Gardner Policy Institute.