Blog Post

Insight: Supply Chain Metals

By: Thomas Holst

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Oct 1, 2021 – My wife gifted me an electric vehicle for my birthday. However, my birthday was three months ago, and I still have not received the birthday present.

Global supply chain problems are the culprit for the delayed delivery of my electric vehicle. The once-in-a-century COVID-19 pandemic created swings in demand, with consumer spending plummeting in 2020 before ramping up again in 2021.

These swings in demand caused supply chain problems with the metals and rare earth elements used to make electric vehicle batteries. These raw materials represent 50%–70% of battery costs, which have declined 83% since 2012. However, the increased demand for these raw materials in 2021 threatens to reverse the long-term trend towards cheaper electric vehicle batteries.

U.S. national energy security was threatened in the late 1970s when OPEC countries embargoed crude oil deliveries. The OPEC embargo spurred crude oil prices to quadruple. In response, the U.S. created strategic petroleum reserves that still exist today, serving as a deterrent to oil import cutoffs and a key tool in foreign policy.

Do current supply chain problems with metals and rare earth elements affect U.S. national security? The Biden administration believes they do. In June, the administration released a strategy to invigorate domestic supply chains, including a review of high-capacity batteries used in electric vehicles. Reformulating the Strategic and Critical Materials Stock Piling Act of 1979 is a stated priority for the current administration.

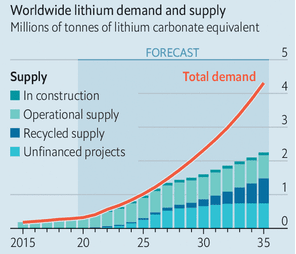

What justification exists for classifying metals used to manufacture high-capacity batteries as a threat to national security? For starters, China controls 70% of global lithium supplies, 80% of graphite supplies, and 80% of rare earth elements. These materials are irreplaceable for everything from high-capacity batteries to solar panels and semiconductors. Global lithium demand will outstrip supply within the next five years according to Benchmark Mineral Intelligence (see Figure 1).

Figure 1: Worldwide Lithium Supply and Demand, 2015–2035

(Millions of metric tons of lithium carbonate equivalent)

Source: Benchmark Mineral Intelligence

Does widespread agreement exist on supply chain strategies? On one hand, corporations employ a just-in-time approach to keep costs low by spreading out the supply chain globally and placing orders on an as-needed basis. On the other hand, when strategic interests are in jeopardy, governments stockpile inventories.

The latest delivery information about my electric vehicle has shifted from supply chains to highway safety. The transporter carrying eight electric vehicles from California to Utah was involved in an accident that knocked the fender off my birthday present.

Thomas Holst is the senior energy analyst at the Kem C. Gardner Policy Institute.