Blog Post

Insight: Record Number of Cash Buyers Are Adding Fire to Utah’s Hot Housing Market

By: Dejan Eskic

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Oct 9, 2020 – Observing Utah’s housing market so far this year, at first glance you wouldn’t think there’s a global health crisis and the world is experiencing an historic economic downturn. Simply put, the housing market is on fire in terms of transactions and pricing. This “fire” is partly due to a lack of existing for-sale inventory, which currently sits approximately 50% below the historic average. Another anecdote heard from real estate agents is that since the pandemic started, we’ve seen an influx of wealthier out-of-state buyers escaping large coastal cities to work from home in more affordable Utah. They’re outbidding other potential home buyers and pay cash, further driving up prices. This has made the market very competitive, pushing the average days on market to a record low of just 11.

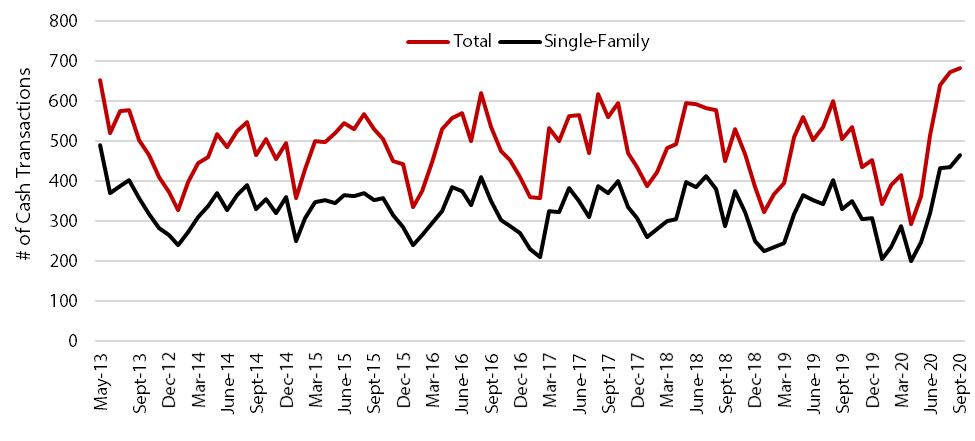

While the data on migration lags, this anecdote is reflected in the number of cash transactions. Since the beginning of the pandemic in late March, the number of cash buyers in Utah has seen a sharp increase, with approximately two-thirds of the transactions being single-family homes (see Figure 1). As the summer buying season heated up, so did the number of cash buyers. Cash transactions reached 682 in September, breaking the previous peak of 653 in May 2013, when cash investors were purchasing foreclosed properties.

Figure 1: Monthly Number of Cash Transactions in Utah, 2013–2020

Source: UtahRealEstate.com

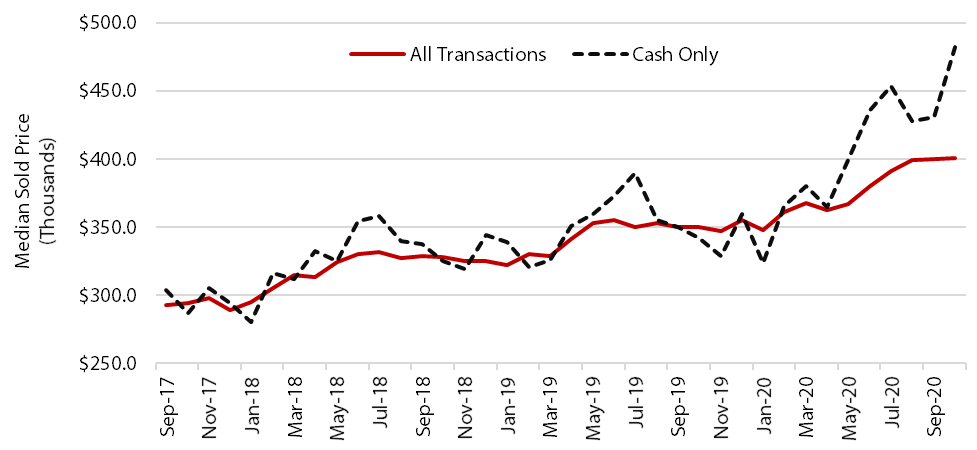

Cash buyers are paying a premium price when compared with all other transactions. Over the three years prior to the start of the pandemic in March, the median cash sales price for a single-family home averaged 1.5% higher than the median price for all transactions (see Figure2). Since April, however, cash transaction median sales prices have averaged 10.8% higher. Additionally, between April and September, the median sales price increased 9.5% overall, while the price of a cash transaction increased 18.0%.

Figure 2: Monthly Median Single-Family Sales Price by Transaction Type in Utah, 2017–2020

Source: UtahRealEstate.com

The social and behavioral impacts consumers are navigating as a result of COVID-19 will take some time to understand. But one effect is becoming clear. The shift to working from home is putting direct pressure on the housing market, increasing demand for single-family homes. The combination of this shift with historically low mortgage rates and an influx of cash buyers is pricing many first-time home buyers out of the market, making it difficult for them to take advantage of low interest rates.

Dejan Eskic is a senior research analyst at the Kem C. Gardner Policy Institute.