Blog Post

Insight: New BEA Data Uncover a Burgeoning Industry: Outdoor Recreation

By: Jennifer Leaver

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Feb 5, 2020 – I have long suspected—either while desperately searching for a parking spot in Big Cottonwood Canyon, waiting in long lines at REI, or watching another outdoor gear manufacturer set roots in Utah—that Utah’s outdoor recreation industry is growing. Well, now there’s proof!

In September 2018, the U.S. Bureau of Economic Analysis (BEA) produced its first-ever assessment and analysis of the nation’s outdoor recreation industry—an industry that made up 2.2% of GDP in 2017. The 2018 Outdoor Recreation Satellite Account (ORSA) report looked at the relative size and impact of this burgeoning industry on a national level. A year later, the BEA took it a step further and released outdoor recreation industry data by state. The BEA’s “prototype statistics” (meaning they can be refined later) measure outdoor recreation industry value added, employment, and compensation in each state from 2012 to 2017.

So, what do the ORSA data tell us about Utah’s outdoor recreation industry?

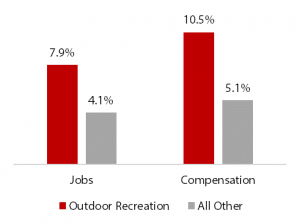

First, Utah ranks in the top 10 states for outdoor recreation value added, employment, and compensation as percent of total. In other words, the outdoor recreation industry plays a greater role in Utah’s economy than it does in most other states’ economies. Second, Utah’s outdoor recreation industry is growing faster than the rest of Utah’s economy. From 2016 to 2017, private outdoor recreation employment and compensation grew at twice the rate of all other private employment and compensation (see Figure 1).

Figure 1: Change in Utah Private Employment, 2016–2017

Note: Employment consists of full-time, part-time, and temporary wage and salary jobs; compensation consists of the pay to employees (including wages and salaries, plus benefits such as employer contributions to pension and health funds). Self-employed are not included.

Source: Kem C. Gardner Policy Institute analysis of U.S. Bureau of Economic Analysis and U.S. Bureau of Labor Statistics data

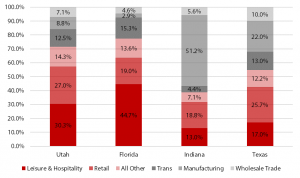

In addition, the state-level ORSA data highlight each state’s industry composition for outdoor recreation value added. Although Utah’s outdoor recreation industry composition mirrors that of other western states and the nation as a whole, there are differences when we compare Utah to other select states, such as Florida, Indiana, and Texas.

Figure 2: Industry Composition of Outdoor Recreation Value Added, 2017

Note: Value added consists of the value of outdoor recreation goods and services less the cost of intermediate goods and services used to produce them. Includes self-employed activity.

Source: Kem C. Gardner Policy Institute analysis of U.S. Bureau of Economic Analysis data

While the leisure and hospitality sector constituted about one-third of Utah’s outdoor recreation total value added in 2017, leisure and hospitality accounted for nearly half of Florida’s and only one-seventh of Indiana’s total value added. Manufacturing, on the other hand, accounted for over half of Indiana’s and almost a quarter of Texas’s outdoor recreation value added, but made up only 9% of Utah’s and 3% of Florida’s total. Utah’s retail sector constituted a larger share (27%) than Florida’s and Indiana’s (both 19%), and Texas had the largest wholesale trade share of all four states at 10%.

Finally, it is important to note that the outdoor recreation industry differs from the travel and tourism industry, even though the two industries overlap in places. The BEA provides travel and tourism data via its U.S. Travel and Tourism Satellite Account (TTSA). Unlike the recent ORSA data, however, the TTSA data are available only at the national level. The recent availability of ORSA’s national- and state-level data helps to better inform outdoor recreation industry businesses and partners, as well as state and national policymakers, about this expanding industry.

Jennifer Leaver is the senior tourism analyst at the Kem C. Gardner Policy Institute.