Blog Post

Insight: Where Does Utah’s Housing Market go from Here?

By: Dejan Eskic

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Mortgage rates have increased from 3.76% in February to 5.23% in May, one of the most drastic increases on record in such a short timeframe.[i] Historically, with rising rates we see prices starting to moderate or even stall. However, Utah’s housing prices increased 24.4% between April 2021 and April 2022, all while rates increased from 3.06% to 4.98% in the same period.[ii] What’s more shocking is that the median monthly mortgage payment increased from approximately $1,629 to $2,556, rising 56%. What’s even more shocking is that our median days on market is six days![iii]

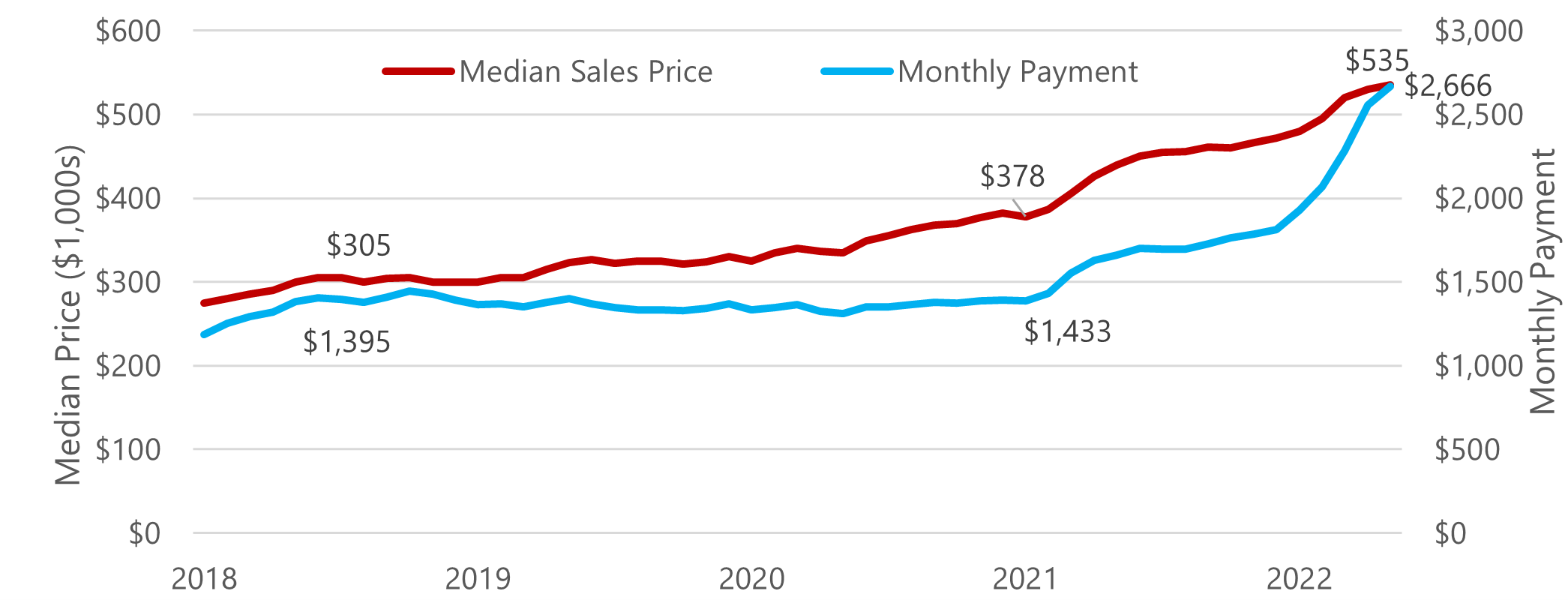

Low mortgage rates masked the increase in housing price growth for a while. From mid-2018 through the beginning of 2021, the monthly payment stayed relatively unchanged, while prices increased about $73,000 (see Figure 1). Since early in 2021, however, the monthly payment growth has outpaced the growth in prices. So, what can we expect for housing prices going forward?

Figure 1: Monthly Median Sales Price and Monthly Median Payment in Utah

Note: Monthly payment assumes corresponding average 30-year fixed mortgage rate and a 10% down payment.

Source: Kem C. Gardner Policy Institute calculation of UtahRealEstate.com and Freddie Mac Primary Mortgage Survey.

Currently, housing price forecasters indicate national prices will likely increase 10.4% in 2022, and another 3.4% in 2023.[iv] Historically, however, Utah’s rate of growth tends to be slightly higher than national figures. Therefore, we can assume our housing prices will follow this trend. But what would it take for prices to actually decrease?

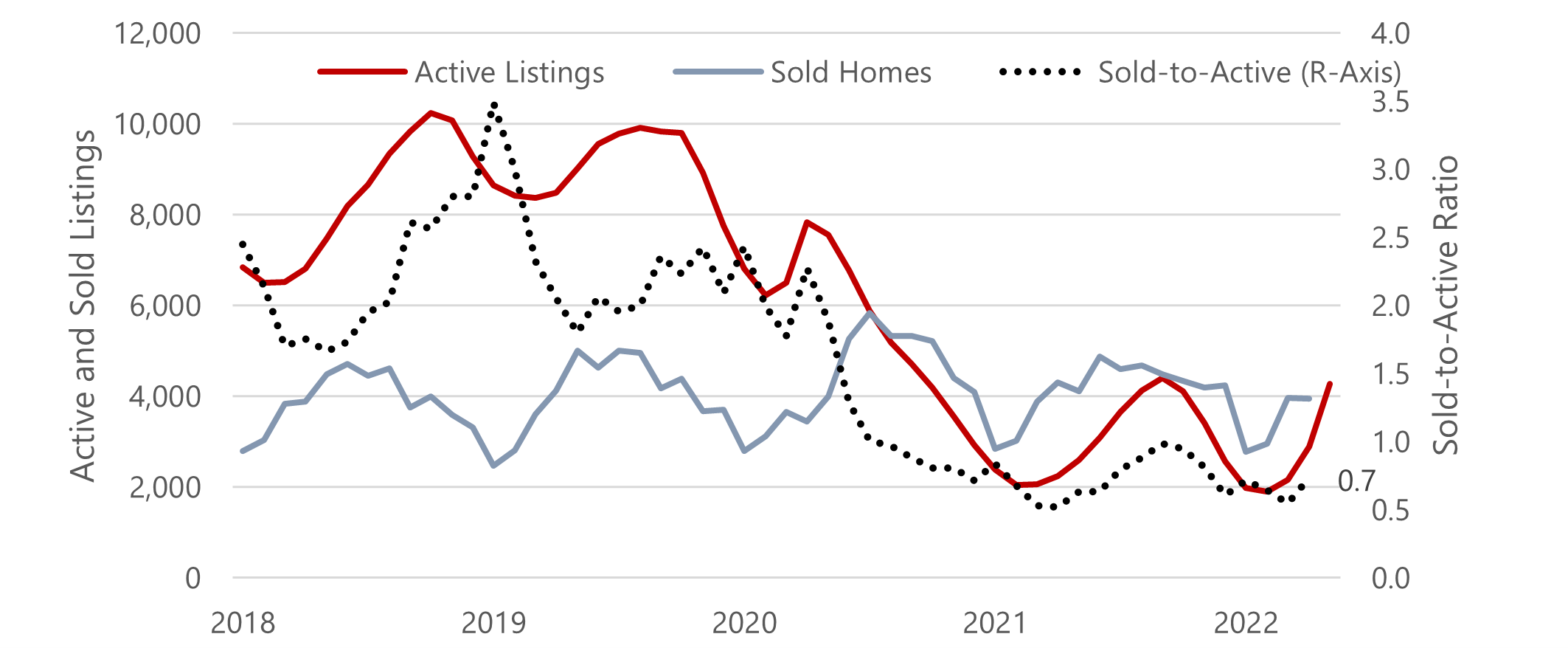

Prolonged higher interest rates and pre-pandemic levels of inventory would create a scenario where prices slow, or dare I say, even decline. We have the high rates, but we don’t have the inventory. While inventory of active homes for sale is increasing exponentially, it is still 49.1% below the pre-pandemic averages (see Figure 2). Prior to the pandemic, 2.3 new listings hit the market for every home sold. Since January 2021, only 0.7 new homes were listed for every one sale. For a balanced market, we need to get the sales to active listings ratio to a monthly range between 1.5 and 2.0.

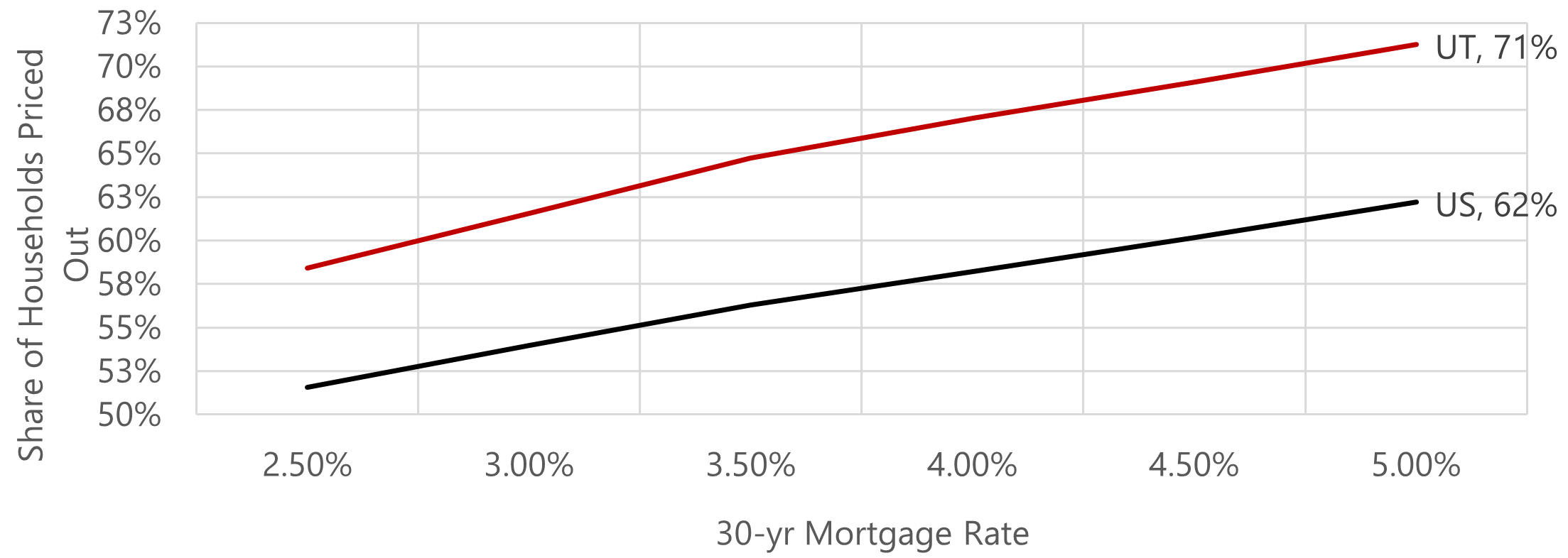

Another factor that favors price acceleration to slow is affordability. With the increase in interest rates and prices, close to 71.0% of Utah’s households are priced out of the median priced home.

Figure 2: Average Monthly Active Listings and Monthly Sales in Utah

Source: Kem C. Gardner Policy Institute calculation of UtahRealEstate.com data.

Figure 3: Share of Utah and US Households Priced Out of the Median-Priced Home Based on Interest Rates, 2021Q4

Note: Assumes 30% debt-to-income, PMI, annual property tax, and 30-yr rate.

Source: Calculations based on U.S. Census Bureau 2019 1-year ACS Survey Income Data (adjusted to 2020), NAR 2021 Q4 Median Sales Price data.

The shrinking affordability is forcing existing sellers to stay in their homes longer. The dramatic rise in rates is adding to the inventory challenges. Approximately 75.0% of Utah’s mortgages are below 4.0% and 31.0% are below 3.0%. The incentive to sell your home and move to a pricier mortgage with a higher rate is likely to keep inventory lower for the next year. Oh, and we are expecting another 248,539 households in Utah by 2030, but that’s a story for another day.

Dejan Eskic is a Senior Research Fellow at the Kem C. Gardner Policy Institute.

[i] Primary Mortgage Market Survey (May 26, 2022). Freddie Mac. https://www.freddiemac.com/pmms

[ii] UtahRealEstate.com

[iii] UtahRealEstate.com

[iv] Average figure calculated based on forecasts from Moody’s Analytics, Mortgage Bankers Association, National Association of Realtors, Freddie Mac, Fannie Mae, Wells Fargo, and IHS Global