Blog Post

Insight: A Record Hot Housing Market: Where Do We Go from Here?

By: Dejan Eskic

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Last April, as the economy was spiraling down and unemployment claims hit what looked like a made-up number, I thought, “Well, at least home prices will drop and we can buy our dream home.” Here I am, nine months into a home search, continuing to be outbid, living with my in-laws. How wrong and naïve I was! But at least I wasn’t alone—most national economists thought we would see a slight price decline early in the pandemic.

Instead, housing prices in Utah and the nation accelerated to new heights. I wrote about the main drivers of the housing price acceleration last fall. It boiled down to three things. First, the pent-up demand from our decade-long housing shortage was further exacerbated by a surge in in-migration. Second, as the number of COVID-19 cases grew and the economy worsened, the hesitation of existing homeowners to put their properties on the market led to record low inventory. Third, record low mortgage rates incentivized buyers to make higher offers while keeping the monthly payment steady.

Fast forward to February 2021, and housing prices are up 15.5% from February 2020 across the state. As of last week, the 30-year mortgage rose into the 3.3% range, a pre-pandemic figure and up from a 2.65% low. And demand continues, as reflected by the single-digit days-on-market for existing homes.

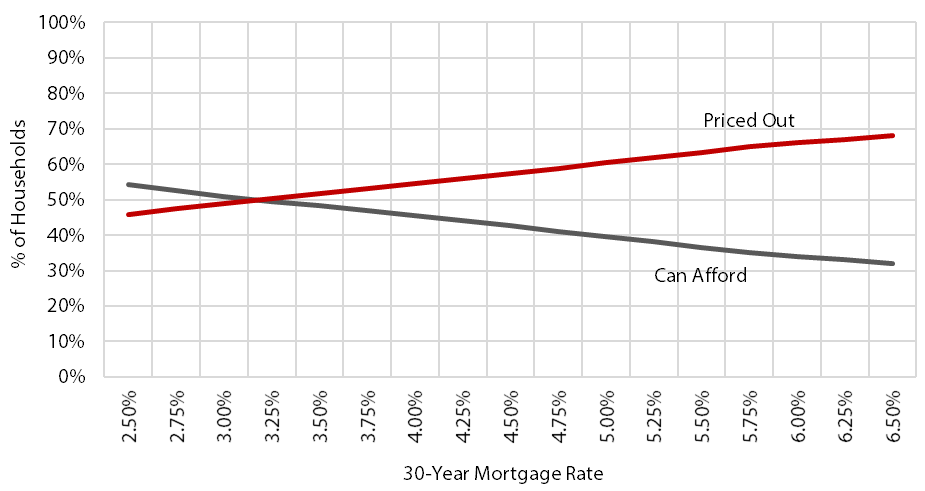

So, where do we go from here? A recent post by the National Association of Home Builders calculated that 75.1 million households in the U.S. can’t afford the median-priced home. In Utah, that’s approximately 502,000, or 49% of households (see Figure 1). As prices are expected to continue their growth, albeit likely moderating in 2021, more Utahns will be priced out, especially as interest rates start to moderate upwards from the historic lows seen in 2020.

Figure 1: Share of Utah Households Priced Out of the Market by an Increase in Interest Rates, 2021

Note: Assumes 30% debt-to-income, PMI, annual avg. 30-yr mortgage, and property taxes.

Source: Calculated by Kem C. Gardner Policy Institute. Based on U.S. Census Bureau, 2019 1-Year American Community Survey data. Home sales data provided by UtahRealEstate.com

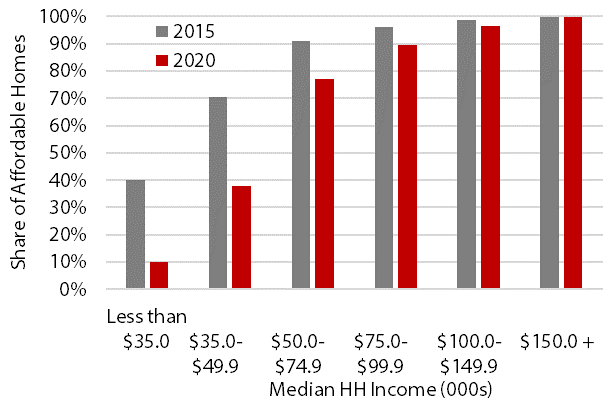

While my family and I feel very fortunate to be in a position to buy a home, hope dwindles a little each week. The availability of affordable/entry-priced housing has decreased over the last five years. Households with incomes less than $35,000 in 2015 could afford 40% of homes on the market that year. In 2020, their share of affordable homes had dwindled to only 10%. Renters, whose median income in 2019 was $47,681, saw their share of affordable homes shrink from 71% in 2015 to 38% in 2020.

Figure 2: Available Affordable Homes by Household Income, Utah

Note: Assumes 30% debt-to-income, PMI, annual avg. 30-yr mortgage, and property taxes.

Source: Calculated by Kem C. Gardner Policy Institute based on U.S. Census Bureau, 2019 1-Year American Community Survey data. Home sales data provided by UtahRealEstate.com

The housing price boom, overall, is a bright spot in a dark year. But it does make me hesitant about the future and takes the issue of housing affordability to another level. For those households who have yet to recover from the COVID recession, what are their prospects in terms of housing stability? Not only are more households likely to be priced out, but renters face an even steeper path to homeownership with less affordable supply. Those homeowners looking to grow their family and move up, face stiff competition. While retirees on a fixed income looking to downsize might be “stuck” in their oversized homes due to a lack of affordable inventory. Sooner or later, the issue of housing affordability will touch every single one of us.

Dejan Eskic is a senior research fellow at the Kem C. Gardner Policy Institute.