Blog Post

Insight: 2015 Utah Office Construction Near Record Levels

By: James Wood

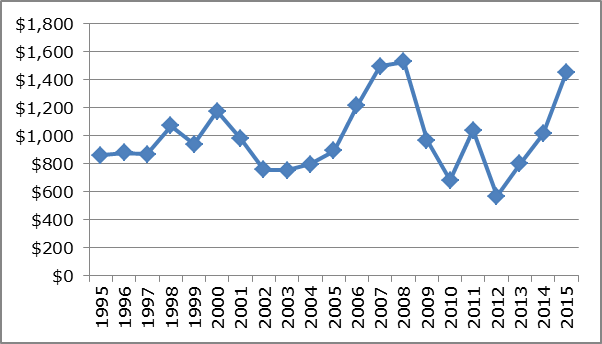

The value of construction activity in Utah is at its highest level in seven years. Through the second quarter of 2015 Utah office construction statewide totaled $3.6 billion, including $2.1 billion in residential construction and $1.5 billion in nonresidential construction. Most surprising has been the strength of the nonresidential sector with construction value approaching the record level of 2008 (see Figure 1). Much of the strength of the nonresidential sector is due to new industrial and office building development (see Table 1).

Figure 1

Value of Nonresidential Construction in Utah

January through June 2015 | millions of dollars

Table 1

Value of Permit Authorized Nonresidential Construction in Utah

Figures in millions of dollars

| Jan-June

2014 |

Jan-June

2015 |

Numeric Change | Percent

Change |

|

| Industrial, Warehouse, and Manufacturing Buildings | $129.1 | $352.5 | $223.4 | 173.0% |

| Office and Professional Buildings | $168.3 | $239.1 | $70.8 | 42.1% |

| Other Nonresidential Buildings | $178.5 | 229.7 | $51.2 | 28.7% |

| Hotels& Motels | $14.0 | $36.5 | $22.5 | 160.7% |

| Hospital & Institutional Buildings | $89.7 | $106.8 | $17.1 | 19.1% |

| Retail and Restaurants | $111.7 | $100.2 | -11.5 | -10.3% |

| Additions and Alterations to Buildings | $316.2 | $387.4 | $71.2 | 22.6% |

| Total Value of New Nonresidential Construction | $1,007.5 | $1,45108 | $373.5 | 44.1% |

| Source: The Policy Institute, University of Utah | ||||

The industrial building sector received a substantial boost from the expansion of the Holly Frontier Corporation’s refinery at Woods Cross. The $216 million expansion will increase Holly’s refining capacity from 31,000 bpd to 45,000 bpd. Even without the refinery expansion the value of industrial construction would be ahead of last year.

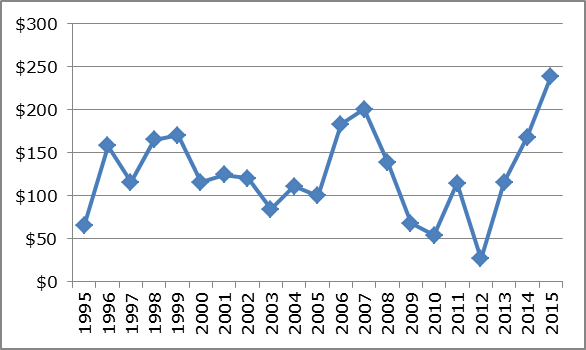

Most impressive has been the level of office development; $239 million in new construction through the second quarter. Through June the value of office construction was forty-two percent higher than in 2014 and at an all-time high for the first six months of the year (see Figure 2). The previous high was $200 million in 2007 (inflation adjusted dollars). Nevertheless new office development will need to remain very strong through the third and fourth quarters to surpass the record high of $461 million (inflation adjusted) in 2007.

Figure 2

Value of New Office Construction in Utah

Figures are in millions of dollars

Office development this year has been concentrated in two cities – Lehi and Midvale. These two cities account for almost half of the statewide new office building valuation – Lehi with $73.7 million and Midvale with $41.5 million. New office development in Lehi has been located around the Thanksgiving Point area. Over the past two years Lehi has had a total of $100 million in office construction. This year will certainly set a record for Lehi with a chance of a $100 million in development in a single year.

In Midvale, office development is centered in the Bingham Junction area, the site of the old Sharon Steel tailings. After several years of cleanup this 350 acre site was “remediated for reuse” in 2006. The recession slowed development at the site, but since 2011 the value of development has climbed to nearly $400 million in commercial and residential development including new office buildings. This year office development in Midvale will certainly set a record somewhere near the $50 million mark.

When I drive through Thanksgiving Point and Bingham Junction and see the millions of dollars of investment I can’t help but wonder about the development of the 700 acres at the Utah State Prison site and the role that prime land will play in future commercial and residential development.

James Wood is the Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute.