Blog Post

Insight: Utah’s GDP Growth: a story of consistent recovery

By: John Downen

The U.S. Bureau of Economic Analysis maintains statistics on the composition and performance of the nation’s and the states’ economies. The BEA recently released 2017 numbers for gross domestic product (GDP) by state. GDP is the most common measure of an area’s economic output and measures the value of goods and services produced in a region minus the cost of the goods and services used in the production process. Looking at Utah’s growth both recently and since the end of the Great Recession gives us a good idea of the rise of some industries and the decline of others.

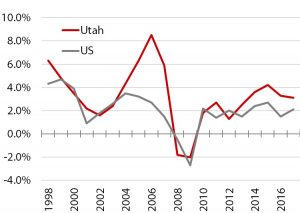

From 2016 to 2017 the nation’s GDP grew by 2.1 percent after adjusting for inflation. This was an improvement over 2016’s 1.5 percent real growth rate, but it was slower than what we saw in 2014 and 2015. Among the states, Utah was the fifth fastest-growing in 2017, with an increase of 3.1 percent to $165.5 billion. While this is the slowest rate since 2013, it’s still a healthy level of growth (see figure 1). Since the Great Recession ended in 2009, Utah has been among the 10 fastest-growing states in six out of eight years, and among the top five for the last three years. Utah’s improving economic performance has been the most consistent compared to other states since the recovery began.

Figure 1: Real GDP Annual Growth Rate, 1998–2017

Source: U.S. Bureau of Economic Analysis

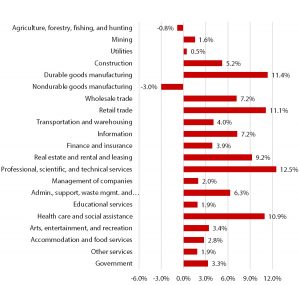

Utah’s 2016–17 performance was driven by professional, scientific, and technical services; durable goods manufacturing; retail trade; and health care and social assistance (see figure 2). These four sectors each contributed more than 10 percent of the state’s growth and together accounted for almost half of total real GDP growth. Professional, scientific, and technical services (lawyers, architects, engineers, computer programmers, photographers, translators, and the like) made the biggest contribution, growing by about 6 percent and accounting for one-eighth of total growth. Durable goods manufacturing (stuff that has an average life of at least three years), retail trade, and health care and social assistance each accounted for about 10 percent of total GDP growth, while expanding by about 5 percent each. Two sectors shrank from 2016 to 2017: agriculture, forestry, fishing, and hunting declined by almost 6 percent and non-durable goods manufacturing (stuff that lasts less than three years) by 2 percent. As a result, theirs were negative contributions to the state’s GDP growth.

Figure 2: Industry Shares of Utah Real GDP Growth, 2016–2017

Source: Kem C. Gardner Policy Institute analysis of U.S. Bureau of Economic Analysis data

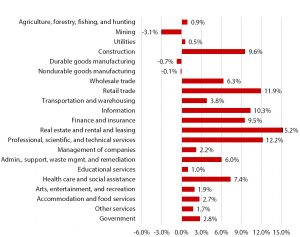

Looking at the state’s economic performance since the end of the Great Recession, real estate, rental, and leasing has been the largest contributor to Utah’s recovery, accounting for 15 percent of state GDP growth between 2009 and 2017 (see figure 3). Another five sectors each added roughly 10 percent or more to GDP growth over the period: professional, scientific, and technical services; retail trade; information; construction; and finance and insurance. These six sectors combined represent two-thirds of Utah’s 25 percent GDP growth since the recession ended. Three sectors have seen net declines in output during the recovery: mining, durable goods manufacturing, and non-durable goods manufacturing. Most notably, between 2009 and 2017 mining, which is sensitive to international events affecting oil and gas prices, shrank by almost one-quarter. As a result, these sectors have dampened the state’s performance.

Figure 3: Industry Shares of Utah Real GDP Growth, 2009–2017

Source: Kem C. Gardner Policy Institute analysis of U.S. Bureau of Economic Analysis data

Utah continues to rack up accolades for its strong economy, well-managed government, and vibrant entrepreneurial culture. The latest GDP numbers bear this out. Both recently and since the end of the recession the state’s economic growth has been broad-based and enduring. Recent trends indicate our economy may be slowing a bit, but Utah remains a land of opportunity.

John Downen is a senior managing economist at the Gardner Policy Institute.