Blog Post

Insight: What’s Driving Our Office Real Estate Growth?

By: Dejan Eskic

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Driving up and down the I-15 corridor, few things are as evident as the growth in the number of new office buildings. The last decade saw approximately 11.5 million square feet of new office space constructed in Utah and Salt Lake counties. Between 2010 and 2019, Utah County’s market size nearly doubled, while Salt Lake County’s office footprint increased by 22%. Combined, the total square feet of the two markets increased by approximately 31%.[1]

Growth has accelerated in recent years. Since 2014, the two counties combined have added an average of 1.7 million square feet of new office space annually. For comparison, the average annual construction from 2010 to 2013 was 350,000 square feet. So, what is driving this growth?

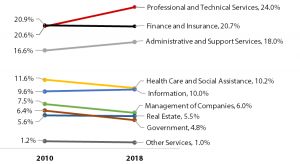

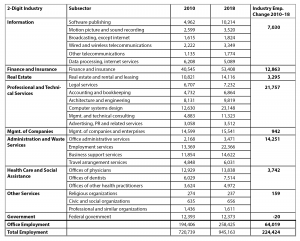

The obvious answer is jobs. But what kind of jobs? As shown in Figure 1, nearly one-in-four office-using jobs are in Professional and Technical Services, a sector dominated by computer system design and management and technical consulting (Table 1). The Finance and Insurance sector’s share has remained near 21% throughout the decade. The Administrative and Support Services sector’s share has grown, primarily driven by the Employment Services subsector, which includes recruiting and staffing agencies.

Figure 1: Share of Office-Using Employment, Utah and Salt Lake Counties, 2010–2018

Source: Kem C. Gardner Policy Institute analysis of Bureau of Labor Statistics data

Table 1: Office-Using Employment by Industry, Utah and Salt Lake Counties, 2010–2018

Source: Bureau of Labor Statistics, Moody’s Analytics Office-Using Categories

As economists look into their crystal balls to figure out when the good times will end, the diversity of office-using employment positions the Salt Lake–Utah County market well to weather whatever may come our way.

Dejan Eskic is a senior research analyst at the Kem C. Gardner Policy Institute.

[1] CBRE, Salt Lake City historical office data