Blog Post

Insight: Utah’s Resilient Economic Recovery

By: Phil Dean

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.

Utah’s economy has proven to be incredibly resilient over the past year. While some sectors face continuing challenges, on the whole the state’s economy has dramatically recovered from the pandemic-induced decline that began in March 2020. Utah is poised for further growth as the virus’ spread moves toward further containment. Although economic risks remain, as widespread containment occurs, the combined effect of accumulated savings and significant pent-up demand will support enhanced economic activity, particularly in the most-challenged economic sectors.

Looking Back at March and April 2020

While many had heard of a strange new virus moving through countries like China and Italy, this vague problem from faraway places abruptly became stark reality for Utahns almost overnight when Utah Jazz star players Rudy Gobert and Donovan Mitchell tested positive for the COVID-19 virus nearly a year ago. In quick succession, not only did the NBA shut down, but previously strong economic activity suddenly took a nosedive.

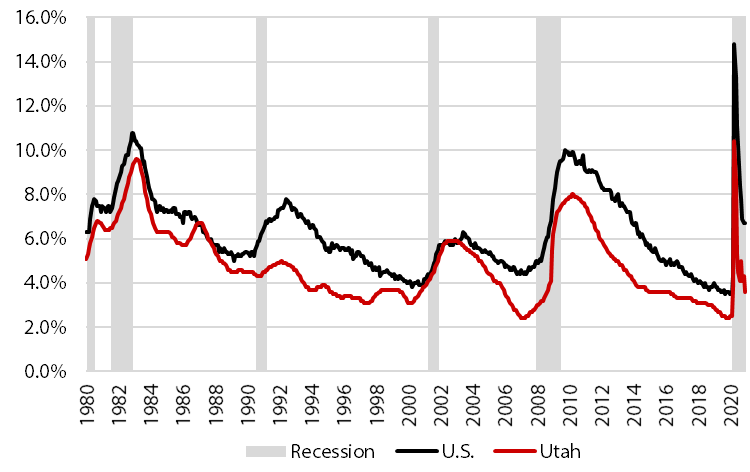

Widespread virus-created uncertainty, combined with rapidly emerging private and public sector responses to that uncertainty, took hold. As consumer and business leader confidence plummeted and public health guidelines increased, unemployment rose dramatically from all-time lows. As shown in Figure 1, in April 2020 Utah’s unemployment spiked to 10.4%, a rate unseen in decades, while the national unemployment rate peaked at 14.8%. Given the prior economic strength both locally and nationally, this sudden jolt caught most off guard.

Figure 1: Unemployment Rate in Utah and U.S., 1980–2020

Source: U.S. Bureau of Labor Statistics and National Bureau of Economic Research

Utah’s Economic Stabilization and Recovery

Unlike the Great Recession’s (December 2007 to June 2009) housing market bubble and dot-com recession’s (March to December 2001) technology sector bubble, economic excesses did not cause the pandemic recession. Rather, society’s response to an unknown virus discouraged or in some cases prohibited certain economic activity. Thus, economic recovery was closely tied with public health recovery and the ability to understand, mitigate, and manage the virus’ spread.

Massive federal fiscal intervention through the CARES Act and other federal funding bills both propped up businesses retaining their employees and directly injected spending power into household budgets. As the world learned more and more about the virus and with this massive federal support rolling out, Utah’s economy began to stabilize and then recover.

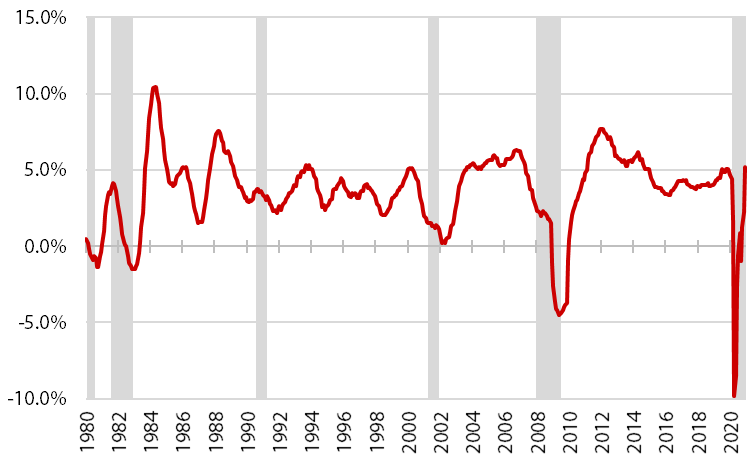

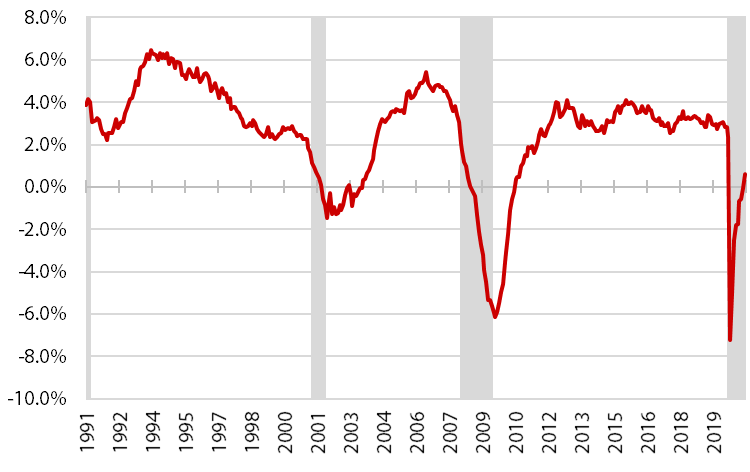

The Federal Reserve Bank of Philadelphia publishes a coincident index, a metric broadly summarizing state-level economic activity. As shown in Figure 2, after a major drop in this comprehensive measure, and with some starts and stops along the way, by December 2020 Utah experienced very significant economic recovery from the pandemic-induced downturn. Similarly, labor markets in Utah returned to positive growth in December 2020, with an initially estimated 0.6% growth rate (see Figure 3).

Figure 2: Year-Over Change in Coincident Index of Utah Economic Activity, 1980–2020

Source: Federal Reserve Bank of Philadelphia and National Bureau of Economic Research

Figure 3: Year-Over Job Change in Utah, 1991–2020

Source: U.S. Bureau of Labor Statistics and National Bureau of Economic Research

K-Shaped Initial Economic Recovery

Even with this impressive rebound overall, aggregate figures hide some very important underlying details. A deeper look reveals that some sectors recovered strongly while others remain heavily impacted. This phenomenon is called a K-shaped recovery.

After an initial shock broadly affecting the economy in March and April 2020, many sectors recovered very strongly, including home and garden, automobile, sporting good, grocery, and furniture retailers, along with remote sellers. In fact, many retailers reported 2020 as among their best years ever.

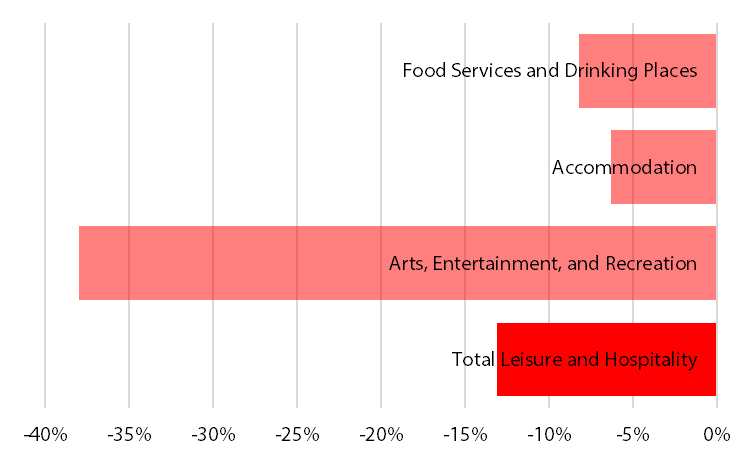

Conversely, other sectors remain heavily impacted today. The travel and tourism industry faces continued challenges, especially in urban areas more reliant on business and convention travel. Even with the season well underway for the NBA-leading Jazz, the events (arts, entertainment, and recreation) subsector of which the Jazz are a part has been significantly impacted. With the events sector the tip of the spear going into the recession in March 2020, it will likely also be one of the last out, as mass gatherings remain limited.

Fortunately, as virus containment occurs, people will want to get out. So these struggling sectors are likely to experience a strong consumer response due to pent-up demand combined with large amounts of excess savings accumulated during 2020.

Figure 4: Year-Over Percent Change in Leisure and Hospitality Jobs, December 2020

Source: Utah Department of Workforce Services

State Tax Revenues

Strong state tax revenue collections followed economic trends. State government leaders recently released updated revenue estimates and will soon make final budget decisions. This strong revenue growth provides state policymakers with many opportunities to continue investing in Utah, including addressing challenges for those still experiencing the pandemic’s challenges.

Phil Dean is the public finance senior research fellow at the Kem C. Gardner Policy Institute.