Blog Post

Insight: Panic at the Pump

By: Thomas Holst

Current motor gasoline prices have shocked Utah motorists. Utah motor gasoline prices jumped $1 per gallon to $4.35. The increase came after the United States and European countries banned Russian energy imports in response to the Ukraine invasion.

International solidarity in condemning Russia’s invasion is heartening. However, U.S. mid-term elections have politicized rising energy costs. Critics shift blame from Russia’s Ukraine invasion to the current administration’s alleged failure to develop oil fields and pipeline projects.

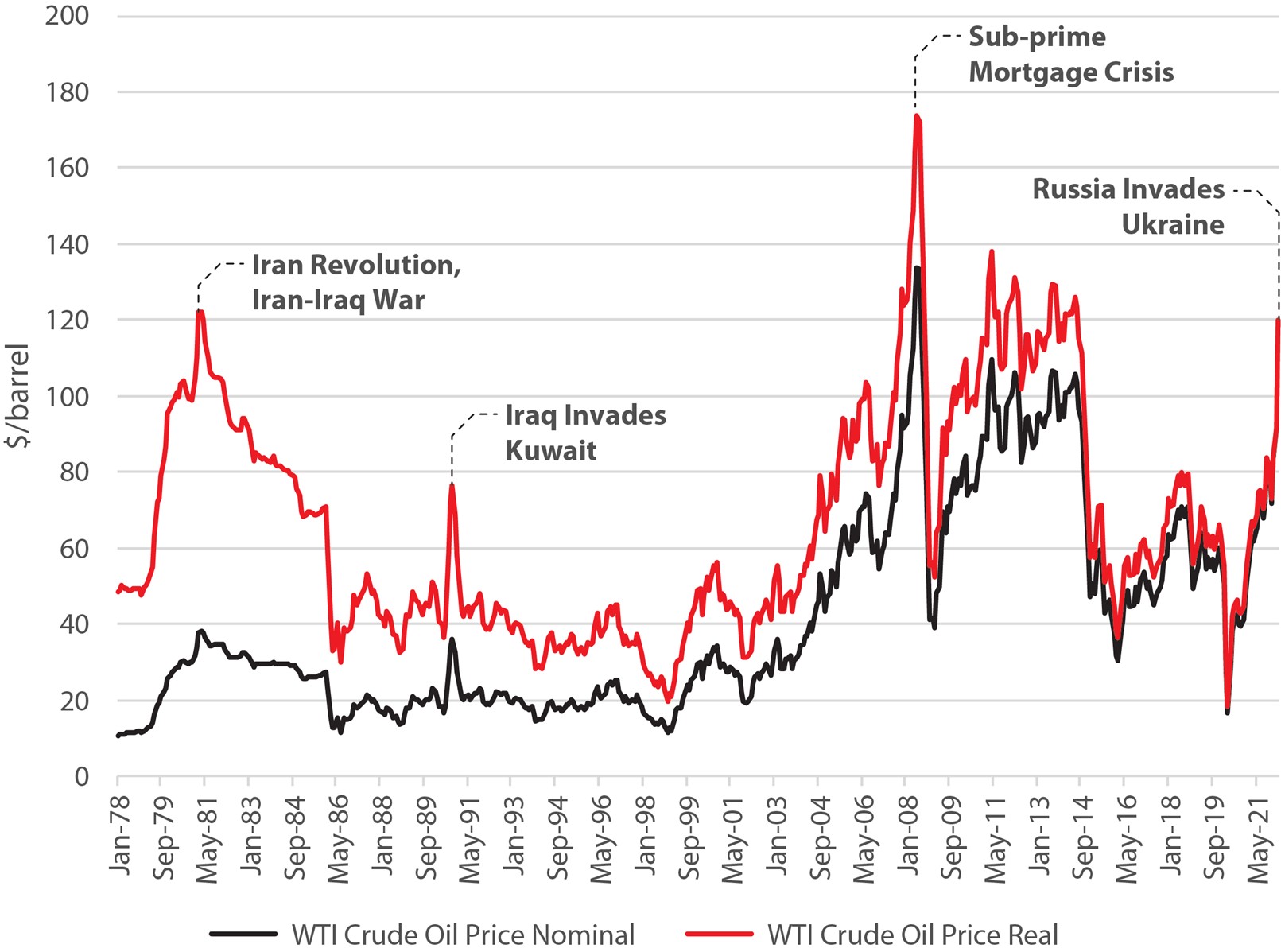

I disagree with these critics. I worked as a commodities trader in overseas assignments in Russia, Germany, and Romania. Energy markets are international. No country can shield itself from the price impacts of war involving crude oil producing nations. The graph below of West Texas Intermediate crude oil prices shows increases coincident to the Iranian revolution and the subsequent Iran-Iraq war in the early 1980s. Conversely, energy prices spiraled down in 2008 and 2020 when the sub-prime mortgage crisis and COVID pandemic dampened U.S. economic activity. The Ukraine invasion sent crude oil prices above $100 per barrel.

West Texas Intermediate crude oil prices (1976-2022)

Source: US Energy Information Administration

Supply and demand drives energy commodity markets.

- Demand for motor gasoline diminished when employees worked from home during COVID. Utah motor gasoline prices dipped below $2.00 per gallon.

- Energy supply uncertainty created by the ban on Russian crude oil imports and potential widening of a Russian invasion into neighboring countries caused gasoline to spike to $4 per gallon in Utah.

Does any positive news come out of this current crisis?

First, economics sanctions on the Russian government may prove an effective deterrent. Russian crude oil exports fund over 60% of its national budget. Without hard currency funds, the Russian government’s ability to finance its Ukraine invasion diminishes. Even Switzerland, historically a neutral player in the European banking sector, has imposed Russian sanctions.

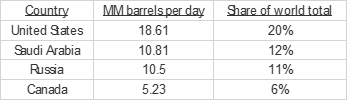

Second, the United States is the largest crude oil producer. Oilfield technologies such as hydraulic fracturing and horizontal drilling have spurred increased production.

Largest Oil Producers and share of total world oil production in 2020

Source: U.S. Energy Information Administration

Third, energy as a share of U.S. personal consumption expenditures has declined thanks to energy efficiency measures and development of renewable energies.

Total energy goods and services as share of total consumption expenditure

Source: Bureau of Economic Analysis, BloombergNEF

Within the dark clouds of this Ukraine invasion, positive aspects about U.S. national energy supplies exist.

Thomas Holst is the senior energy analyst at the Kem C. Gardner Policy Institute.

Note: The opinions expressed are those of the author alone and do not reflect an institutional position of the Gardner Institute. We hope the opinions shared contribute to the marketplace of ideas and help people as they formulate their own INFORMED DECISIONS™.