Blog Post

Insight: Trends in Retail Sales and Housing Prices

By: James Wood

Retail sales in Utah grew by 43 percent from 2003 to 2007, an increase of over $7 billion in just four years. But this remarkable growth was not unique. There have been similar retail booms in Utah’s past and, as in the recent boom, they were closely related to a rapid run-up in housing prices.

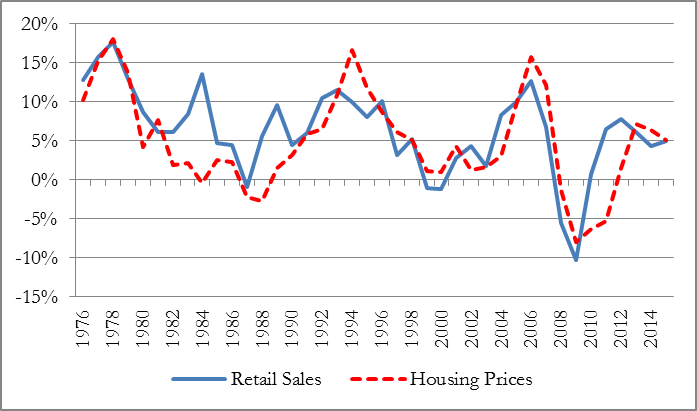

A look at historical data shows a very high correlation between retail sales and housing prices. Increases in retail sales tend to mirror increases in housing prices (see Figure 1). There have been three periods since 1976 when annual housing price increases exceeded 10 percent; 1976-1979, 1993-1995, and 2005-2007. In each period retail sales also expanded dramatically with annual increases in sales of at least 10 percent.

Figure 1: Percent Increase in Housing Prices and Retail Sales

This is not surprising as higher home prices boost home equity and household wealth, which in turn support and encourage higher levels of retail spending. The additional home equity is often turned into a loan or line of credit for retail purchases while the “wealth effect” of increased home equity often lifts consumer confidence and the propensity to spend.

The 2003-2007 retail boom was unique in one respect – the severity of subsequent contraction. It was the first period in Utah’s post war history with a significant decline in retail sales as well as the first period of falling home prices. In 2009 retail sales fell by $2.3 billion, a 10 percent drop while the median sales price of a home fell by eight percent.

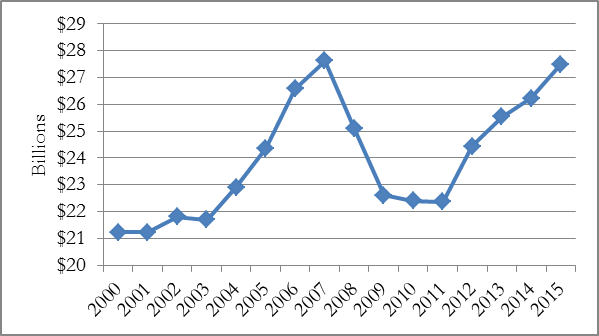

Figure 2: Taxable Retail Sales in Utah (Constant 2015 Dollars)

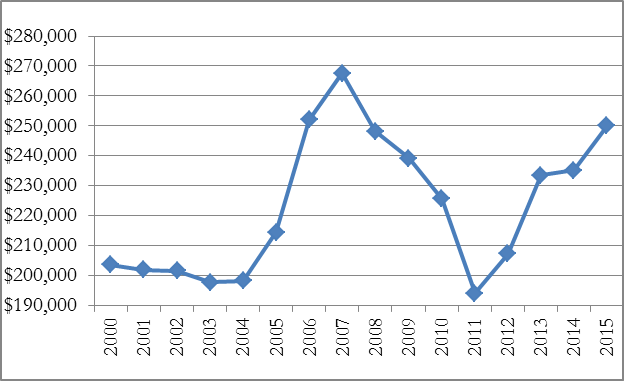

Retail sales in 2015 are forecast to reach $27.5 billion, just a fraction under the record high set in 2007 of $27.6 billion (see Figure 2). While retail sales have recovered I believe housing prices have another year before full recovery. The median sales price of a home in 2015 is still about six percent below the all-time high of $267,600 set in 2007 (see Figure 3).

Figure 3: Median Sales Price of a Home in Utah (2015 Dollars)