Blog Post

Insight: Rising Rents and Sluggish Incomes Squeeze Renters

By: James Wood

For some time, increases in rental rates have outpaced gains in renter’s income. Rental rates are being pushed up by unusually strong demand for apartment living. The housing market has responded with a boom in construction of high quality, high-priced units. Nearly 20,000 apartment units have been completed in the past five years. The typical 1000 square foot, two-bedroom, two bath unit in a new apartment community rents for around $1,300. In a popular rental market such as Salt Lake City’s downtown rental market or the Sugarhouse market, rents will be at least $200 higher for a similar size unit.

Of course, these new units are at the top-end of the market and command a substantial premium. But even when all types of apartment communities are surveyed, including a wide range of projects by age, project size, location and type of units, the average rent for a two-bedroom two bath unit, drops by about $250 to around $1,050. Ten years ago, this average two-bedroom, two bath unit rented for $890 in inflation adjusted 2015 dollars. So, over the past ten years, rents have risen 17 percent in inflation adjusted dollars while the median income of renters has increased a meager three percent. A quick calculation of the rent I paid for my first two-bedroom, two bath apartment in Salt Lake City shows a 50 percent increase in real terms in the rental rate since 1967. No question, starting out today I would pay a much greater share of my income for housing.

The disparity between increases in rental rates and renter’s incomes has made renting much less affordable; consequently, the share of renters with housing cost burdens has grown substantially in the past 10 years. While there is no precise definition of housing affordability, the conventional public policy indicator of housing affordability, at website least in the U.S., is the percent of income spent on housing. When housing costs (including utilities) exceed 30 percent of household income, the household is said to have a housing cost burden. A severe housing cost burden occurs when costs exceed 50 percent of household income.

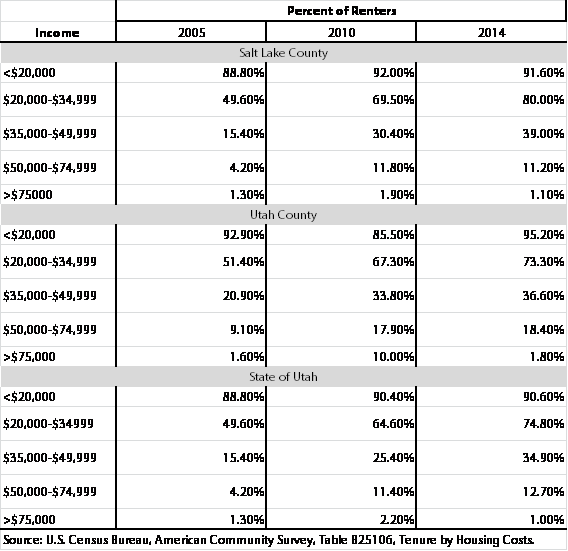

The share of renters with housing cost burdens has climbed sharply for some income groups in the past 10 years. Take for example renter households in Salt Lake County with incomes from $20,000 to $34,999, or about 21,000 households. The share of these renters with housing cost burdens has increased from 50 percent in 2005, to 80 percent in 2014 (see Table 1). In absolute terms, this amounts to an additional 6,000 renter households with housing cost burdens. For renters with incomes from $35,000 to $49,999, the share of cost burdened households has increased from 15 percent to 39 percent. Utah County and the statewide rental market have followed a similar path of declining housing affordability. This trend, which is likely to continue over the next few years, makes the recent housing initiatives by Salt Lake City (5,000 Doors) and Salt Lake County (homeless shelter funding) so welcome, urgent, and necessary.

James Wood is the Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute.