Blog Post

Insight: Food – Struggling Retail’s Best Friend

By: Dejan Eskic

Innovate or die — that is the mantra of many of companies today. This is especially true in retail. Last year was the year of retail apocalypse with more than 5,000 store closures. This year, approximately 3,600 stores are expected to close their doors too. It is counterintuitive to have record store closings when consumer confidence is at an all-time high. I recently heard the phrase “retail isn’t dead, mediocre retail is dead.” The market is transforming for the next generation of shoppers.

By some estimates, America retail is overbuilt by about 50 percent, indicating that we will see much more of this “apocalypse” in the future. Sales are sluggish for some retailers while strong for others and online sales continue to grow each year. Overleveraged companies are filing for bankruptcy as debt obligations are coming to term, leading to so many closures. Department clothing stores are the leading the way in these closures, but do include a mix of pharmacies, toy stores, and other material goods.

The one category missing from these major closures is the grocery store. Most of us visit the grocery on a weekly basis, and if we look closely we notice just how much they have changed over the last few decades. From food delivery, to online ordering, to adding restaurants, grocery stores are always evolving and innovating. The best burger I’ve ever had was at a grocery store in D.C.

Where we get our groceries has also changed. The likes of Walmart and Target have become full service grocery stores with fresh produce and packaged meat being sold along with clothing, décor, electronics, etc. In most markets throughout the U.S., Walmart for example, is in the top 3 in terms of grocery sales market share. Thus, total sales for these stores tend to be much higher when compared to a traditional grocery store. For this reason it is difficult to compare grocery sales and department store sales (Walmart & Target fall into this category) directly.

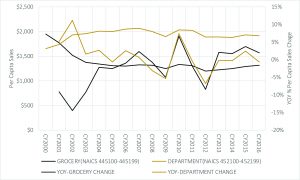

Some interesting trends have occurred since the year 2000 though. In Utah, per capita sales of traditional grocery stores has declined by nearly 30 percent between 2000 and 2016, while increasing by 16 percent for department stores (see figure below). Department stores per capita sales rose above grocery per capita sales in 2002 and have remained so since. Year–over-year change in per capita sales mirrored one another, while grocery sales were declining, department store sales were increasing. Between 2000 and 2006, per capita grocery sales were declining every year. Department stores had the opposite trend as year-over-year per capita sales change have remained fairly positive, with only one decline from 2004 to 2005. Starting in 2007, year-over-year trends have been nearly identical for both grocery and department per capita sales, and per capita sales remained strong during the downturn.

State of Utah Per Capita Sales & Year-Over-Year Change ($2016)

Source: State of Utah Tax Commission

Retailers are continuing to innovate. Those who lag will soon be in the history books. Amazon’s purchase of Whole Foods will have technological impacts that we can’t imagine yet. More traditional grocers are going mobile, with convenience leading research and development. Walmart is investing heavily into technology that tracks the freshness of produce; this has always been the blind spot for food delivery. Some malls are using grocery stores as their anchors to increase traffic. There was a 5 percent increase in 2017 in grocery anchored shopping centers, and the clothing giant Kohl’s, just announced a pilot program to include the discount grocery Aldi in some of their stores. The moral of the story here is that if you have food you will likely survive.

The changing retail landscape poses both problems and once in a lifetime redevelopment opportunities. While cities may see a decline in sales tax revenues, they also have on opportunity to repurpose their now vacant, but infrastructure-already-built sites with new housing, office for startups, or something new we have yet to imagine.

Dejan Eskic is a Senior Research Analyst with the Kem C. Gardner Policy Institute.